How to Track Customer Lifetime Value (CLV) in SaaS

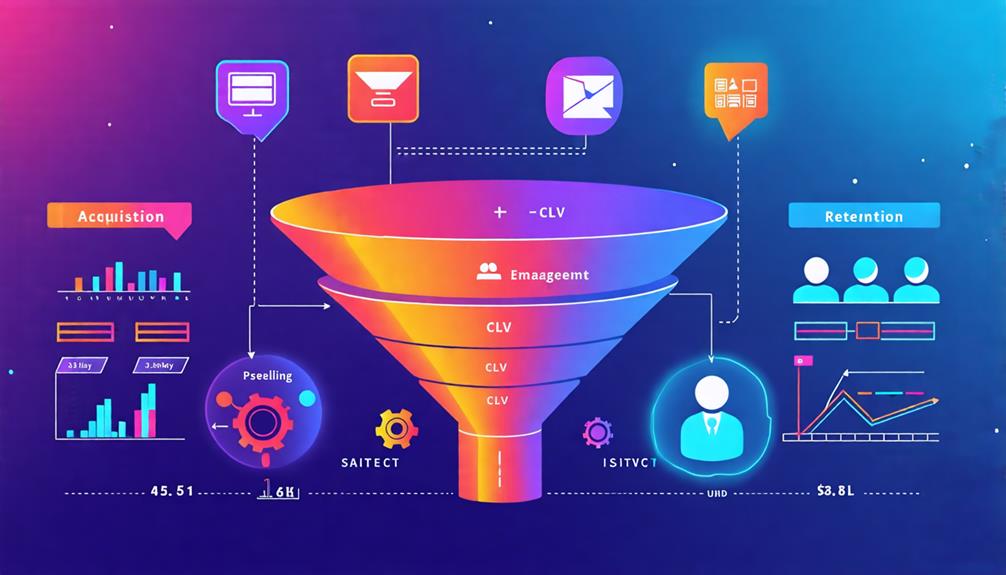

Tracking Customer Lifetime Value (CLV) in your SaaS business requires a comprehensive understanding of key metrics. Focus on elements such as Average Revenue Per User (ARPU) and churn rate, as these metrics provide a solid foundation for evaluating your customer relationships.

By using the formula CLV = ARPU / Churn Rate, you can gauge the financial impact of your retention strategies. However, effective CLV tracking goes beyond calculations—it's crucial to leverage this data to drive sustainable growth and refine your business strategies.

Understanding Customer Lifetime Value

Understanding Customer Lifetime Value (CLV) is crucial for SaaS businesses because it reveals the total revenue you can expect from a customer throughout their relationship with your company. Calculating CLV provides insights into customer retention and helps identify your most valuable customers. This information enables you to focus your marketing strategies on retaining these customers, ultimately driving profit increases.

In the SaaS industry, a 5% increase in customer retention can lead to profit increases of up to 95%. Knowing your CLV helps you assess customer acquisition costs accurately. With precise CLV calculations, you can refine your marketing strategies, ensuring efficient allocation of resources to attract and retain customers.

Valuable customers contribute not only to immediate revenue but also to long-term relationships that enhance brand advocacy. Understanding CLV allows you to make informed decisions affecting various aspects of your business, from pricing models to customer support initiatives.

Calculating Customer Lifetime Value

Calculating Customer Lifetime Value (CLV) is crucial for SaaS businesses to assess the long-term revenue potential of their customers.

A simple formula to start with is:

\[ ext{CLV} = ext{Average Revenue Per User (ARPU)} imes ext{Customer Lifetime} \]

This provides an estimate of the total revenue generated from a customer throughout their relationship with your business.

Another useful formula is:

\[ ext{CLV} = rac{ext{ARPU}}{ext{Churn Rate}} \]

This formula highlights the negative impact of higher churn rates on CLV by reducing the duration of customer relationships.

For a more refined calculation, consider:

\[ ext{CLV} = rac{ext{ARPU} imes ext{Gross Margin \%}}{ext{Revenue Churn Rate}} \]

This approach ensures you account for profitability over time.

To further enhance your calculations, use cohort analysis to identify different customer segments and their respective lifetime values.

This data can help you develop targeted retention strategies tailored to specific groups, thereby improving overall customer retention and profitability.

Importance of Retention Strategies

Retention strategies are crucial for SaaS businesses as they've a direct impact on customer satisfaction and long-term profitability. A mere 5% increase in customer retention can boost profits by 25% to 95%. By concentrating on retention, you can enhance customer lifetime value (CLV) while reducing the customer churn rate. Engaged customers are less likely to leave, making customer engagement a priority.

To refine your retention strategies, systematically assess customer feedback and product features. Understanding your customers' needs leads to higher satisfaction and loyalty, fostering a community that remains loyal. Utilize analytics to monitor retention metrics, helping you identify trends and areas needing improvement. This continuous feedback loop allows you to adapt your strategies and maintain high levels of customer engagement.

Additionally, implementing a robust system for analyzing churn metrics can inform your retention efforts. By addressing the reasons behind churn, you can fine-tune your approach, ensuring sustainable growth. Ultimately, investing in retention strategies not only increases customer loyalty but also enhances your overall business value, laying the groundwork for ongoing success in the competitive SaaS landscape.

CLV and Customer Acquisition Cost

The relationship between Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) is crucial for assessing the profitability and growth potential of your SaaS business. The CLV to CAC ratio is a key metric, with an ideal target of 3:1, meaning you should earn three times more from each customer than you spend on acquiring them. A high CLV relative to CAC indicates effective marketing strategies and strong customer retention, while a low ratio suggests high acquisition costs or poor retention rates.

To calculate CAC, divide your total marketing and sales expenses by the number of new customers acquired over a specific period. This calculation helps evaluate the efficiency of your customer acquisition efforts in relation to the revenue generated from those customers. Monitoring the CLV to CAC ratio over time allows you to assess the impact of marketing investments on customer profitability, informing your budget allocation and growth strategies.

Understanding the interplay between CLV and CAC enables you to optimize your marketing spend, ensuring that your customer acquisition efforts contribute positively to overall business profitability and sustainability. Regularly tracking these metrics helps maintain a healthy balance in your SaaS operations.

Enhancing Customer Lifetime Value

To enhance Customer Lifetime Value, focus on retention strategies that consistently engage your customers. Effective upselling and cross-selling are also crucial for maximizing the potential of existing customer accounts. These techniques not only boost satisfaction but also foster long-term loyalty.

Effective Retention Strategies

Effective strategies for keeping customers engaged can significantly enhance your company's Customer Lifetime Value (CLV). Prioritizing customer retention is essential; investing in product education initiatives like tutorials and webinars helps users comprehend the product's value better, thereby increasing satisfaction and loyalty. When customers feel knowledgeable and empowered, they're less likely to churn.

Providing excellent customer support across multiple channels strengthens relationships and fosters loyalty. Regularly listening to feedback and addressing concerns can substantially improve customer satisfaction. Additionally, introducing reward programs and referral incentives can be beneficial, as studies show retained customers can generate up to 95% more profit than newly acquired ones.

Moreover, developing engaging product features, such as customizable dashboards, keeps users interacting with your software, reducing churn rates and boosting CLV. While upselling and cross-selling techniques can increase revenue, remember that effective retention strategies lay the groundwork for these approaches. By focusing on customer satisfaction, education, and support, you'll cultivate a loyal customer base ready to explore additional offerings when the time is right, ultimately increasing their lifetime value to your business.

Upselling and Cross-Selling Techniques

Upselling and cross-selling techniques can significantly enhance your Customer Lifetime Value (CLV) by encouraging customers to explore higher-tier products and complementary services. Upselling can notably increase your average revenue per customer (ARPC), while cross-selling allows you to recommend products that align with your customers' existing preferences, deepening their connection to your brand.

To optimize these strategies, employ customer segmentation to identify high-value customers most likely to engage with your offers. Tailoring your approach with personalized recommendations based on purchasing patterns can result in a 20-30% increase in conversion rates. Customers are more inclined to spend when suggestions resonate with their needs.

Consistently analyze your upselling and cross-selling efforts and gather feedback to refine your strategies. This iterative process ensures alignment with customer preferences and market trends, leading to sustained improvements in CLV.

Tracking and Analyzing Metrics

Tracking and analyzing key metrics like Average Revenue Per User (ARPU) and churn rate helps you understand the factors influencing Customer Lifetime Value (CLV) in your SaaS business. Start by calculating your Customer Acquisition Cost (CAC) to determine your investment in acquiring new users. Regularly monitor your Monthly Recurring Revenue (MRR) and MRR churn. These figures provide insights into customer monetization trends and retention effectiveness, which are essential for accurate CLV calculations.

Utilize cohort analysis to segment your customers based on shared behaviors or attributes. This approach allows you to evaluate CLV across different groups, revealing which segments are most profitable. Implement analytics tools like Amplitude or Userpilot to visualize your CLV data and track changes over time. This makes it easier to identify trends and areas that need improvement.

Don't underestimate the power of customer feedback. Regularly engage with your users through surveys and in-app prompts. Their insights can guide strategic adjustments, enhancing retention and ultimately increasing CLV.

Conclusion

Tracking customer lifetime value (CLV) in SaaS is essential for understanding and nurturing customer relationships. By accurately calculating CLV and focusing on retention strategies, you can optimize profitability and drive growth.

Monitor your CLV to Customer Acquisition Cost (CAC) ratio to ensure you're investing wisely in customer acquisition. Engaging with your customers through feedback and analytics provides valuable insights that can improve their experience and elevate your bottom line.