Yearly billing can make all the difference in the world for the health of your SaaS business, and I’m going to show you why.

The way a company decides to bill its customers will directly impact revenue streams needed to maintain cash flow and business operations. If you’re building a SaaS company looking for a recurring revenue model, you should take some time to carefully choose your billing period/options.

The more flexible your plans are the easier it is for a customer to buy your product or service. What you want to do is to remove any adoption barriers. That’s why huge companies like Oracle and SAP are now facing new invisible competitors, that start working on a customer as small as one single user per $5/mo.

No strings attached

Monthly billing has become the default standard billing period for a variety of subscription business, including SaaS.

The main reason for that is because monthly billing guarantees one of the main sales arguments of any “as-a-service” business model: no strings attached.

“If a customer churn too soon you won’t see the cash you need to survive”.

As a consumer, you want to be free to cancel your plan whenever you want, right?

If recurring revenue is what makes the SaaS model so great for companies, pay-per-use is what makes it great for customers, and you don’t want to ruin that by holding your customers for 12 months – especially if they don’t like your product.

The flexibility and lower barrier to entry of the monthly subscription are crucial for acquiring new users, but you can’t deny that if a customer churns too soon you won’t see the cash you need to survive.

Cash flow

While cash flow is the main concern for any business no matter what size or industry, it can be a major issue for startups and early-stage business for a quite simple reason: at the end of the day you need to have money to pay your employees salaries, sales & marketing expenses, technology infrastructure and all the resources necessary to keep your business running.

The reason startups get money from venture capital firms is exactly what they need to finance operations until they start getting a return after some time.

As David Skok has demonstrated on his famous “SaaS Metrics 2.0” blog post, SaaS businesses face significant losses in the early years. This is because they have to invest heavily upfront to acquire the customer, but recover the profits from that investment over a long period of time.

It’s important to see that you’re not just worried about CAC: LTV ratio, but also with months to recover CAC. The longer you take to recover CAC the worst it is for the health of your business, and it has everything to do with cash flow.

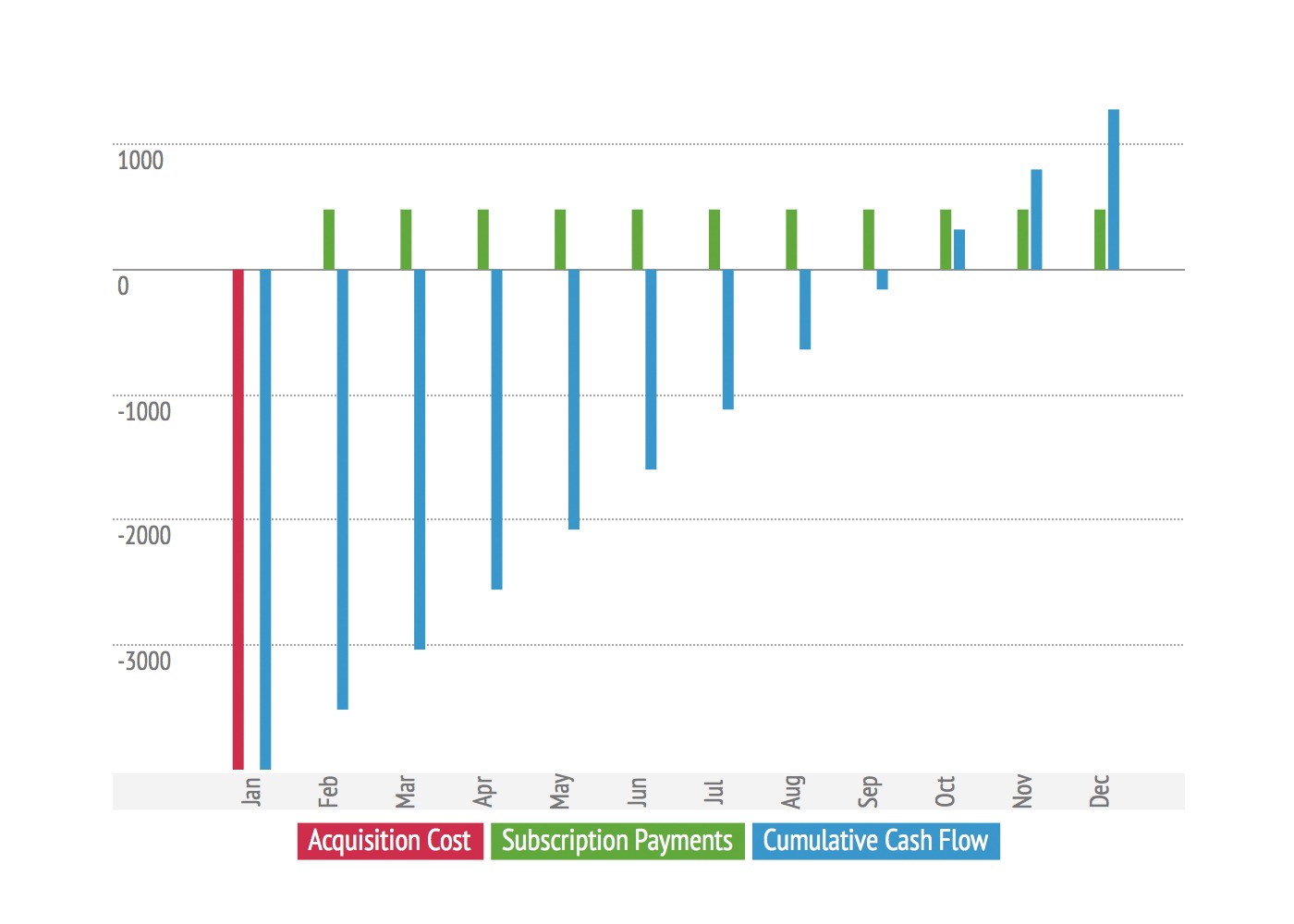

Consider this example below:

It costs a company $4,000 to acquire a new customer, and this customer pays a subscription fee of $480/mo (we’re considering a 12 months period but this customer could be a subscriber for a much longer time).

Note the classic problem: all the cash invested on customer acquisition must be spent in the first month, while the revenue comes over a long period. Considering this scenario you would have a negative cash flow until August.

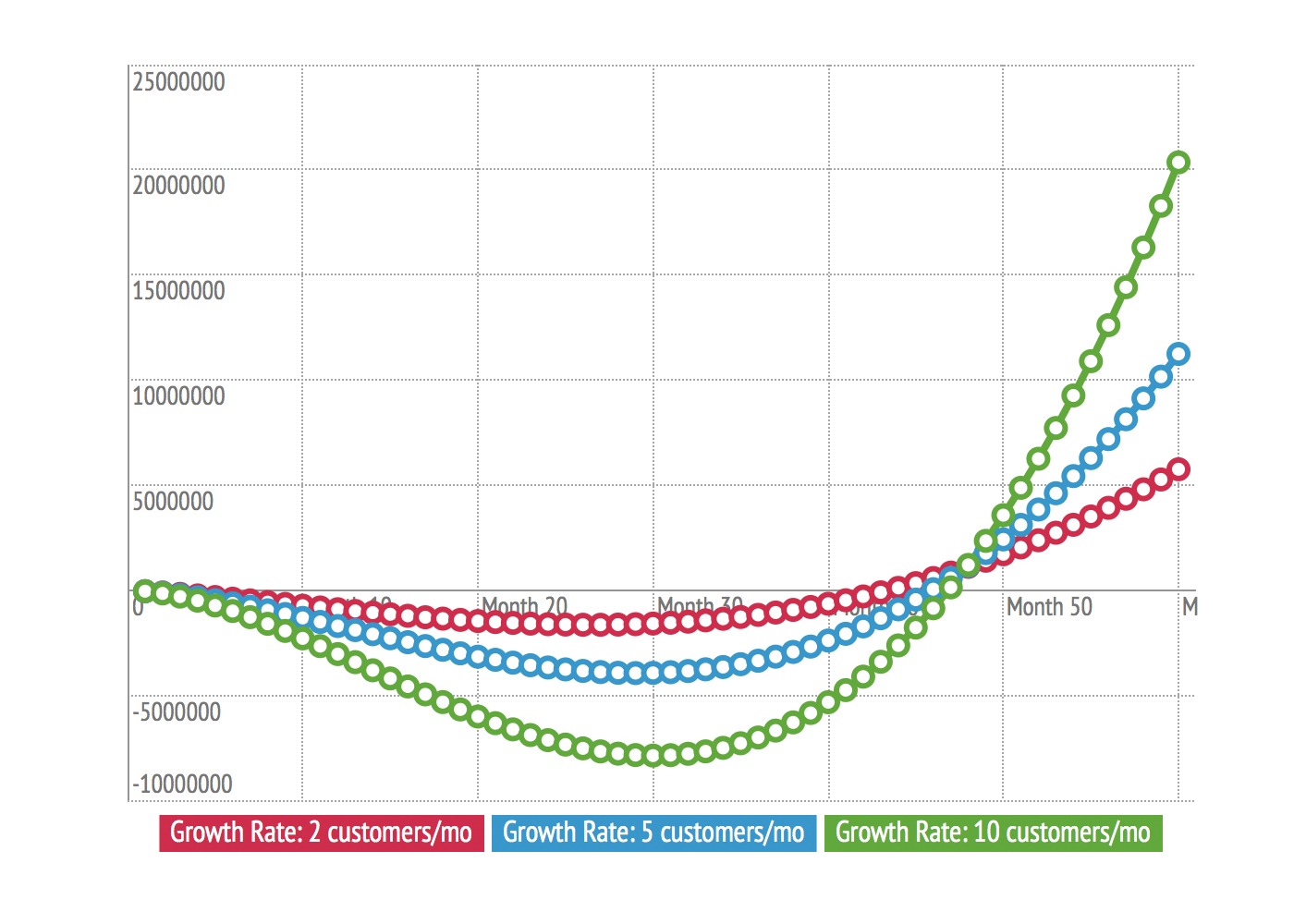

So if we have a negative cash flow for one customer, imagine what would happen if you would want to acquire many customers at the same time? See that your negative cash flow gets deeper if we increase the growth rate for the bookings.

The faster the business decides to grow, the worse the losses become. Many investors/board members have a problem understanding this and want to hit the brakes at precisely the moment when they should be hitting the accelerator.

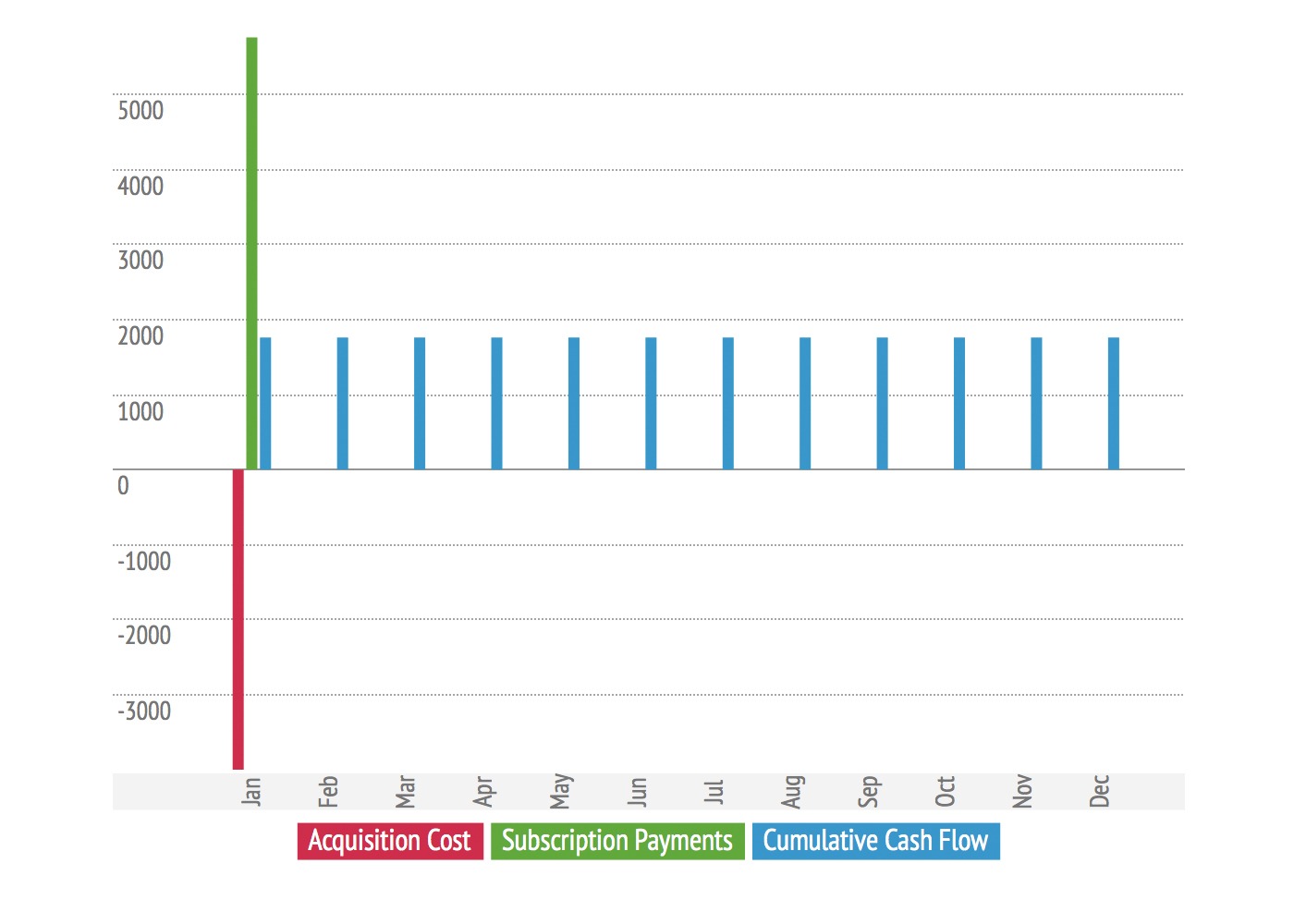

Now let’s say your customer is being billed yearly. You are still going to spend $4,000 upfront on customer acquisition, but you’re also billing all the 12 months ($5,760) upfront.

Note that on this scenario you don’t get negative cash flow. Actually, you get a $1,760 balance that could be used to finance the acquisition of more customers.

Engagement

There’s another important aspect that may influence your decision about billing yearly: engagement. It may be harder than you think to make sure your customer is using your product properly and engaged enough to get the value of it.

In many cases, it takes some times for your customers to start seeing the results of using your product. See our own example at saasmetrics. The longer you’re measuring your metrics, the better it will be for you to understand the results of any specific strategy or decision you have taken – and it’s important that you have at least 6 months of metrics history to compare with actual numbers.

The same thing happens to CRM, marketing automation platforms like HubSpot and many other as-a-service products in the market. That’s where Customer Success makes a huge difference. If you have asked your customers to commit for a 12 month period, the least you could do it support them to make sure they’re getting all the value from your product. It’s completely up to you to make it happen.

How to present yearly billing options?

At this point is probably clear to you that yearly billing is a good option, but to make it work you need to offer an advantage for your customers to opt for it too.

The easiest and probably most effective way of doing that is to offer a discount over the monthly fee. The average number on the market is somewhere between 8 and 12%. Many companies present it as “one month free”, which means you pay for 11 months and get 12 – which is definitely a good option.

Some more aggressive players such as Slack offer two months free for a yearly subscription over month-to-month payments.

Keep in mind that by forcing your customers to opt for yearly billing creates an adoption barrier, and although it’s really good to have all the revenue upfront, it’s better to have it monthly than having no revenue at all.

“Forcing your customers to opt for yearly billing creates an adoption barrier”.

So you have to be careful about how you’re going to present your plans and billings options, depending on your strategy and the moment of your company.

I have created this simple scheme that describes four different levels for how should you present monthly vs. yearly billing options. It’s important to know that the levels are not ordered nor represents your company maturity on billing.

Billing yearly is purely an option and might make sense or not depending on your business specific characteristics – although we truly believe it’s the best approach for the most part of early-stage SaaS companies.

Level 1: Yearly only

At this level, you trust so much your product and your sales team that you present the yearly subscription as the only option. There are no discounts or options to choose from. All your customers are yearly billed.

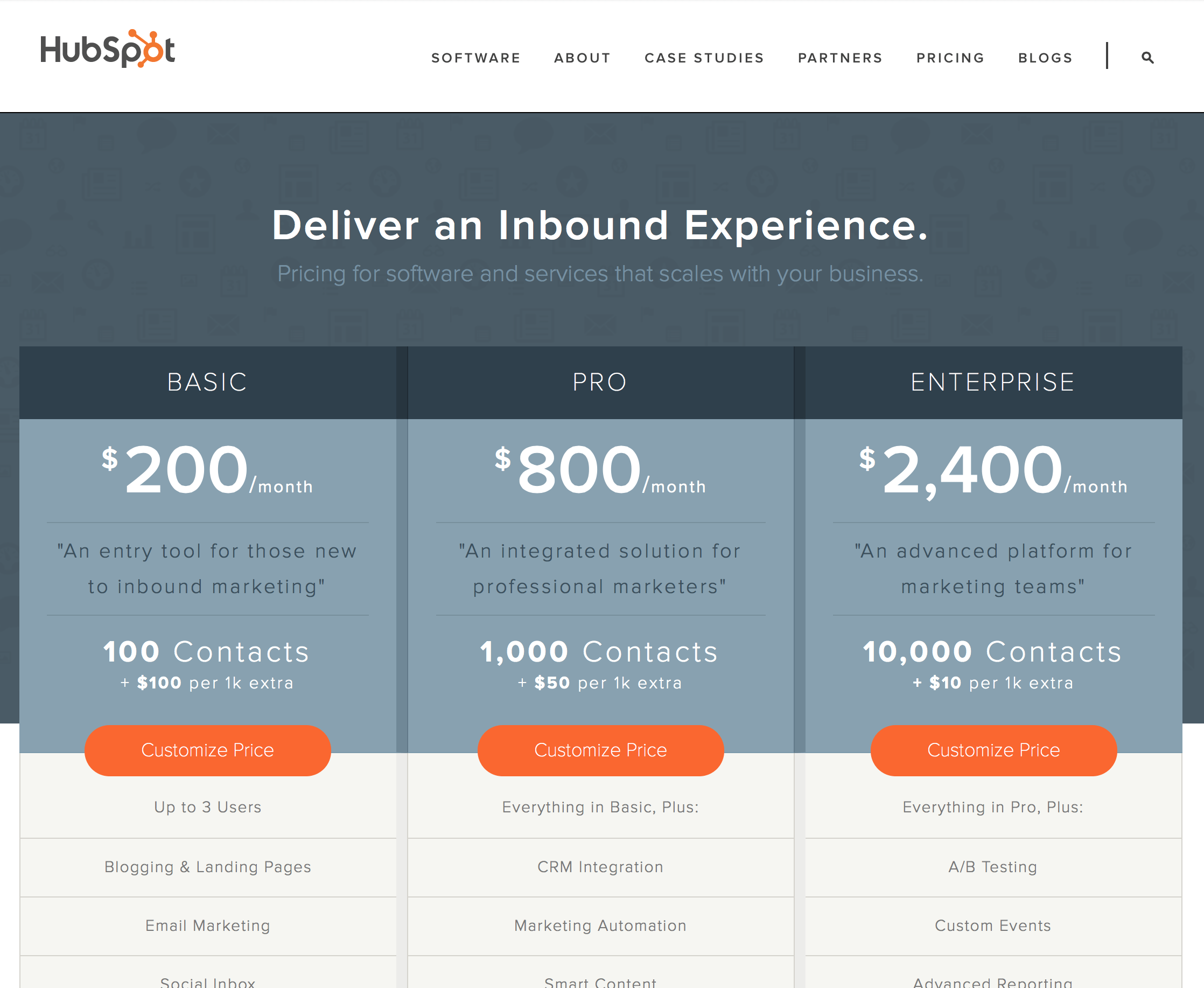

Despite billing yearly you probably want to show the monthly price, always. And that’s just a trick for your perception – you rather not showing high prices so people won’t think your product is too expensive at first sight. It’s the same thing about offering a plan for $29 rather than $30.

Example of companies at this level: Salesforce.com, HubSpot.

Level 2: Yearly default

At this level, you already know the taste of yearly billing and have a good part of your customer being billed yearly. Your web site presents the yearly billing prices by default, but still gives the option of monthly billing.

It’s important that you highlight the benefit of your yearly plans, showing not just a better price but also talking about how customers that have chosen the yearly plans have been more successful using your product.

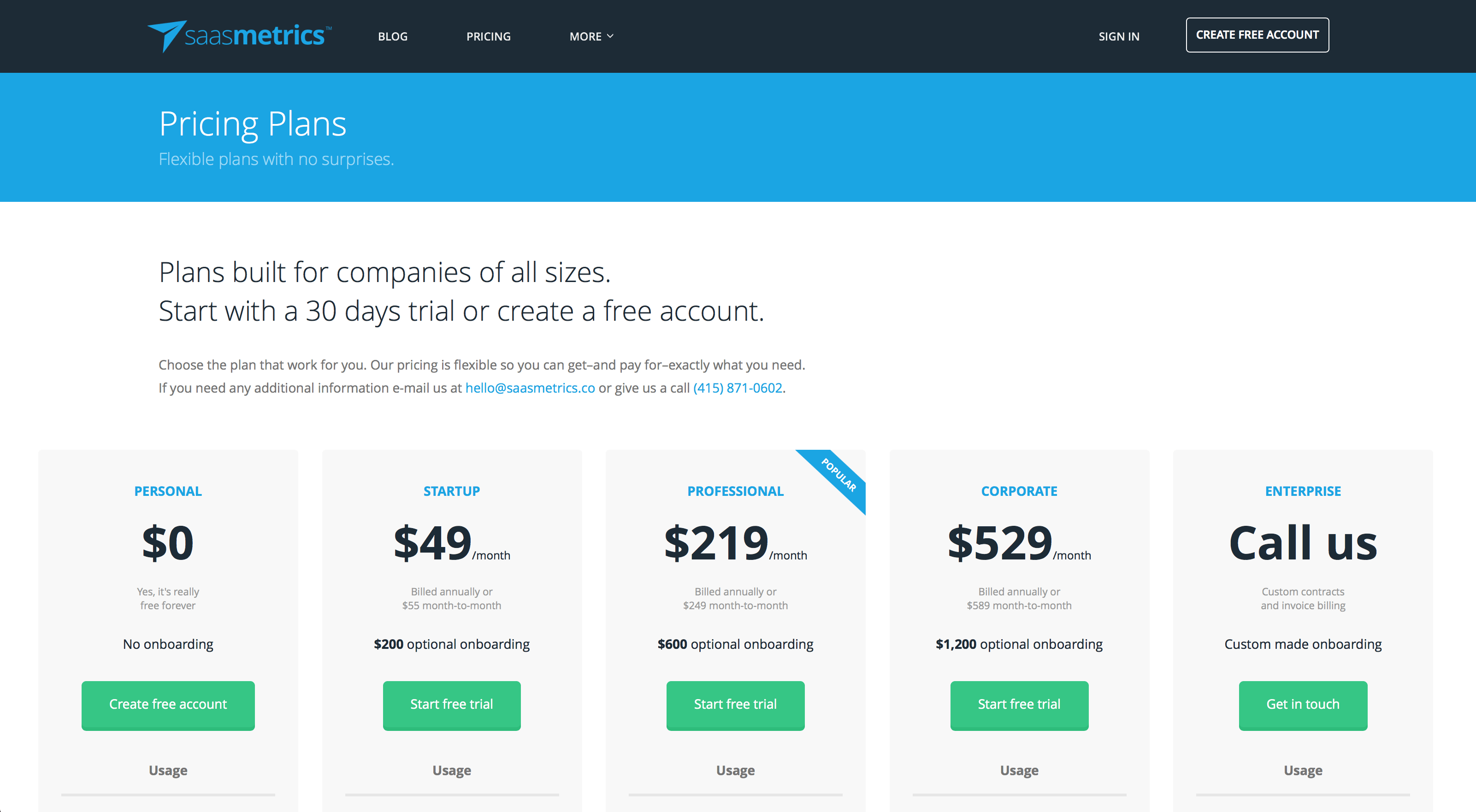

Example of companies at this level: Saasmetrics, Asana, Slack, Zendesk.

Level 3: Yearly options

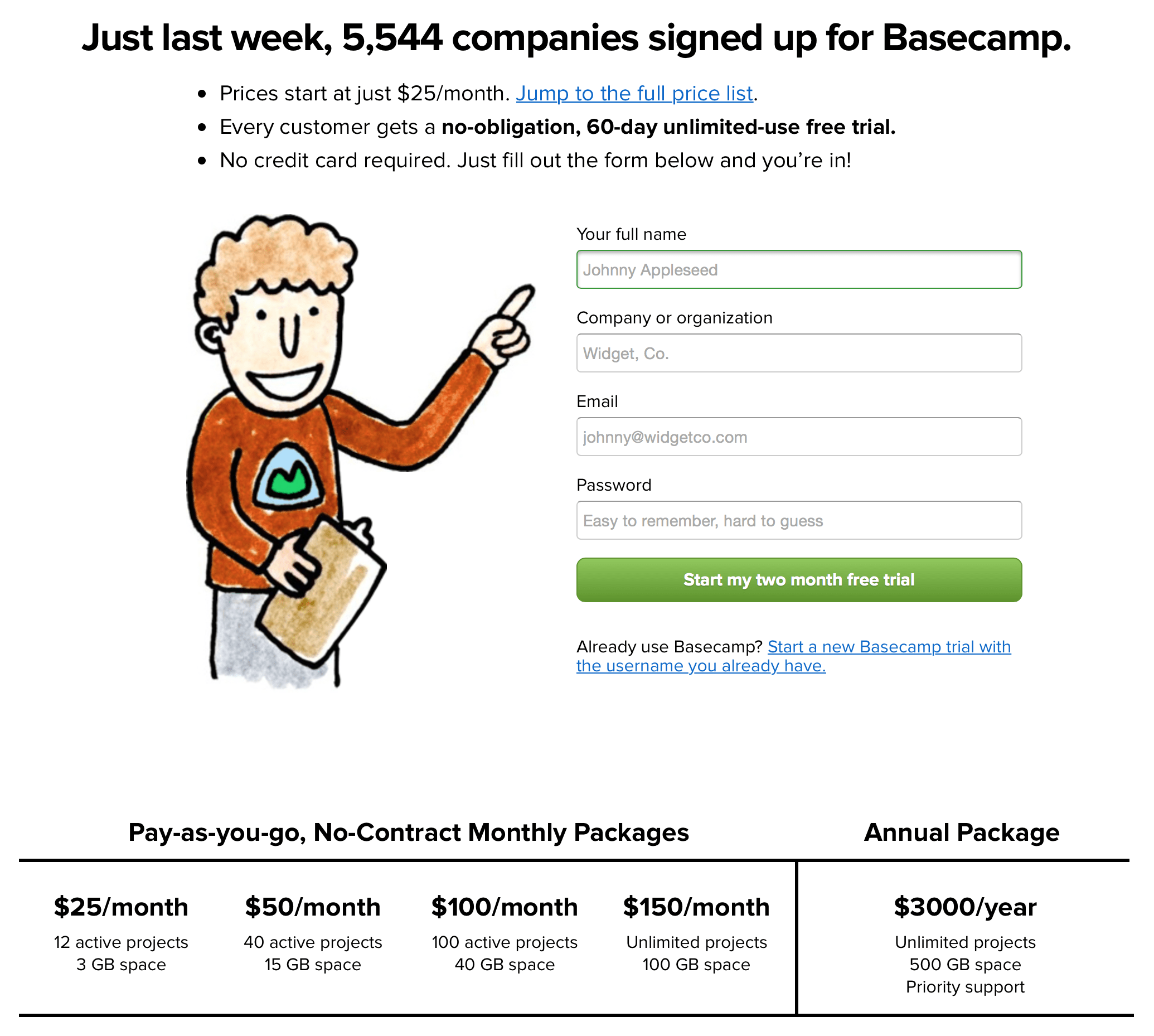

At this level, you rely on monthly billing as your main source of revenue. You present monthly prices by default and present yearly plan as options – no matter what discount you choose to give. You might have a lot or only a few customers being yearly billed.

Although you still highlight eventual benefits for yearly plans you prefer to guarantee the flexibility of monthly plans and create no barriers for adoption.

Example of companies at this level: Basecamp.

Level 4: Monthly only

At this level, despite knowing the benefits of yearly billing, you don’t present yearly billing as an option at all. You prefer to trust your instinct and create a product free of adoption barriers, accelerate your growth and users base.

This might be common to companies that have been recently funded and don’t depend on revenue to finance customer acquisition. Keep in mind that the strategy may change over time.

Example of companies at this level: Github, Pipedrive, Groove.

Wrap up

The main reason for offering yearly billing is cash flow. Unless you’re well funded you might face cash flow issues by investing a lot of money on customer acquisitions upfront, while your revenue comes over time.

Keep in mind that yearly plans can be considered adoption barriers to your product or service so you want to offer your customers a benefit (usually discounts) to choose yearly plans over monthly.

Don’t forget to mention to your customers about how engagement is important and how customers that have committed for a year have been more successful using your product and getting the value of it.

Lastly, make sure to choose the right approach to present your plans and billing options, depending on your strategy, priorities and the moment of your company.