What Are SaaS Metrics Benchmarks?

SaaS metrics benchmarks are industry standards that help gauge your company's performance relative to others in the market. Metrics like Annual Recurring Revenue (ARR) and Customer Acquisition Cost (CAC) are critical for determining your market position. These benchmarks identify areas for improvement and help set realistic growth targets. But what should you do when the numbers don't match your expectations? Understanding the reasons behind these discrepancies and addressing them is crucial. So, how can you effectively use these benchmarks to drive strategic decisions?

Understanding SaaS Benchmarking

Understanding SaaS benchmarking is crucial for evaluating your business performance against industry standards. By comparing key performance metrics like Annual Recurring Revenue (ARR) growth, Customer Acquisition Cost (CAC), and Churn Rate, you gain valuable insights into your company's operational efficiency and financial health. Effective SaaS benchmarking helps you understand where you stand in the market and identify areas for improvement.

To guarantee the accuracy of your benchmarks, it's critical to use clean and reliable data. Without accurate data, your comparisons can be skewed, leading to misguided strategic decisions. For early-stage SaaS companies, the lack of historical data can make this challenging, but focusing on gathering consistent and reliable data over time will pay off. Mature firms might face complexities in data collection, but streamlining these processes is essential for precise evaluation.

The SaaS Rule of 40, which suggests achieving a combined growth rate and profit margin of 40%, serves as a useful benchmark for assessing financial health and operational efficiency. By selecting relevant metrics that align with your business priorities, you can avoid data overload and facilitate collaboration between departments and executives, ultimately driving your company's success.

Key SaaS Metrics

When evaluating your SaaS business's performance, key metrics such as Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Monthly Recurring Revenue (MRR), and Churn Rate are essential. These metrics provide a comprehensive view of your company's health and growth potential.

- Annual Recurring Revenue (ARR): This is a critical indicator of your business's long-term viability. Aim for a year-over-year growth rate of 20-30% to remain competitive.

- Customer Acquisition Cost (CAC): This metric measures the total cost of sales and marketing efforts to acquire a new customer. A typical CAC for B2B SaaS is around $200. Strive for an LTV to CAC ratio of 3:1 to ensure sustainable growth.

- Monthly Recurring Revenue (MRR): Monitoring MRR helps gauge your company's short-term financial health. A 10% month-over-month increase is considered robust, indicating effective customer retention and acquisition strategies.

- Churn Rate: This rate measures customer retention. Mature SaaS companies should aim for a monthly churn rate of 5-7%, while early-stage startups should target around 5%.

Benchmarking Challenges

Key SaaS metrics offer valuable insights, yet benchmarking these metrics presents several challenges. Early-stage SaaS companies often struggle with a lack of historical data, making it difficult to set realistic performance goals. Without sufficient historical data, comparisons can be skewed, leading to incomplete interpretations of performance indicators.

For mature SaaS firms, benchmarking remains complex. Market dynamics and operational changes can distort results, and ignoring these factors may lead to inaccurate conclusions. Benchmarking against dissimilar companies can also yield misleading insights, making it crucial to select peers that closely resemble your business model and market context.

Another significant challenge is focusing on relevant metrics. An excessive focus on numerous or irrelevant metrics can obscure actual performance. Prioritizing the most impactful benchmarks is essential for clear analysis. Additionally, ineffective data collection processes can hinder accurate benchmarking. Clean and reliable data are necessary to ensure valid comparisons and actionable insights.

To overcome these challenges, ensure semantic consistency, relevance, and trustworthiness in your benchmarking approach. This includes using interoperable metrics that align with industry standards and maintaining concise and complete data records. By focusing on these principles, you can achieve more accurate and actionable benchmarking outcomes.

Data Reporting and Dashboards

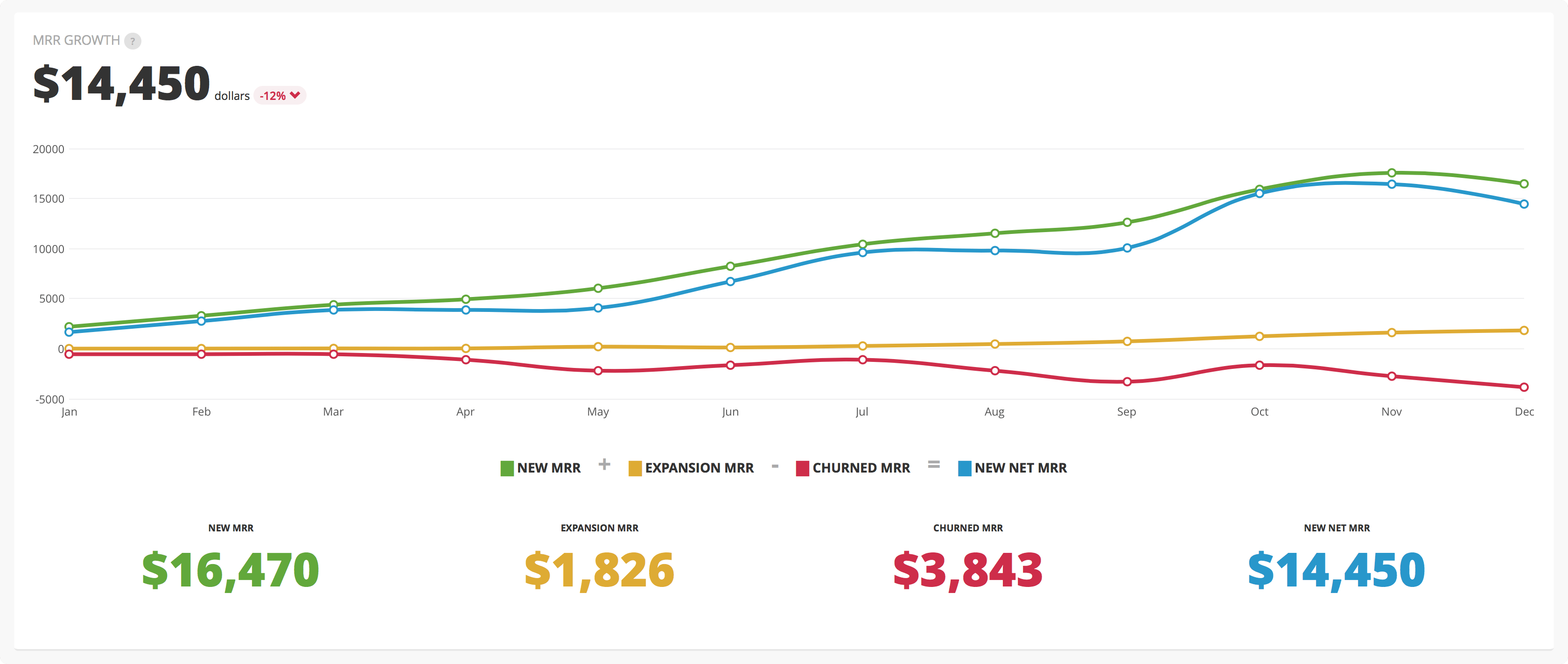

Effective data reporting and dashboards are crucial for successful SaaS operations. Reliable and clean data is essential for accurate metric calculations and informed decision-making. Customized dashboards enable real-time tracking of key performance indicators (KPIs) such as Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC), providing enhanced visibility for executives.

To ensure the efficacy of your data reporting and dashboards, follow these guidelines:

- Consistent Data Collection: Establish routines for consistent data collection. This ensures the accuracy and timeliness of metrics on your dashboards, facilitating swift strategic adjustments.

- Financial Storytelling: Leverage your data to create compelling financial narratives. This helps stakeholders easily understand performance outcomes and the impact of operational metrics.

- Prebuilt Groupings: Use prebuilt groupings for metrics like operational efficiency and retention. These streamline the monitoring process and help you stay aligned with industry benchmarks.

- Real-time Tracking: Implement real-time tracking for KPIs on your dashboards. This maintains an up-to-date view of your SaaS metrics, enabling proactive management and rapid response to performance deviations.

Actionable Insights

Gathering actionable insights from your SaaS metrics is essential for driving strategic decisions and operational improvements. By closely analyzing key metrics like Customer Acquisition Cost (CAC), Net Revenue Retention (NRR), Lifetime Value (LTV), and churn rate, you can identify growth opportunities and enhance financial performance.

For instance, maintaining a CAC below $200 ensures efficient customer acquisition spending, while an LTV to CAC ratio of 3:1 indicates a profitable customer acquisition strategy. Monitoring your churn rate is equally critical; aiming for a rate between 5-7% helps sustain customer retention and revenue stability. Additionally, a Net Revenue Retention rate above 100% signifies successful upsells and cross-sells, promoting sustainable growth.

Here's a quick reference table to help you benchmark your metrics:

| Metric | Ideal Range/Ratio | Importance |

|---|---|---|

| Customer Acquisition Cost | Below $200 | Ensures efficient customer acquisition spending |

| Net Revenue Retention (NRR) | Above 100% | Indicates growth from existing customers |

| Lifetime Value to CAC Ratio | 3:1 | Guarantees profitable customer acquisition |

| Churn Rate | 5-7% | Maintains customer retention and stability |