Top Performance Metrics Every SaaS Company Should Track

As a SaaS company, tracking the right performance metrics is crucial for your success. Key metrics such as Customer Churn and Revenue Churn are essential for gauging customer satisfaction and financial stability.

Additionally, Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) provide valuable insights into the effectiveness of your marketing strategies. However, there are other critical indicators that can significantly influence your growth.

Understanding these additional metrics can offer deeper insights into your business operations. Let's explore which metrics you might be overlooking and how they could transform your approach.

Customer Churn

Customer churn is a critical metric that indicates the percentage of customers who discontinue using your service over a given period, typically ranging from 5-7% for SaaS companies. Monitoring customer churn is essential to understand its impact on overall customer retention and satisfaction. High churn rates can signify issues with customer satisfaction or engagement, necessitating immediate corrective actions.

By analyzing churn data, you can identify which customer segments and industries are most likely to leave. This insight enables you to address specific pain points and enhance your product's value proposition. Effective retention efforts should focus on improving customer satisfaction and ensuring customer success, which are pivotal in reducing churn.

Consistently tracking churn rates is crucial for forecasting future revenue and making informed business decisions. Noticing high churn rates indicates a need to refine your strategies and optimize your offerings. Reducing churn not only boosts customer retention but also strengthens the overall health of your business.

Revenue Churn

Revenue churn measures the financial impact of losing customers through cancellations and downgrades. Understanding the causes of churn is crucial for identifying areas to improve your product and enhance customer satisfaction.

Understanding Revenue Impact

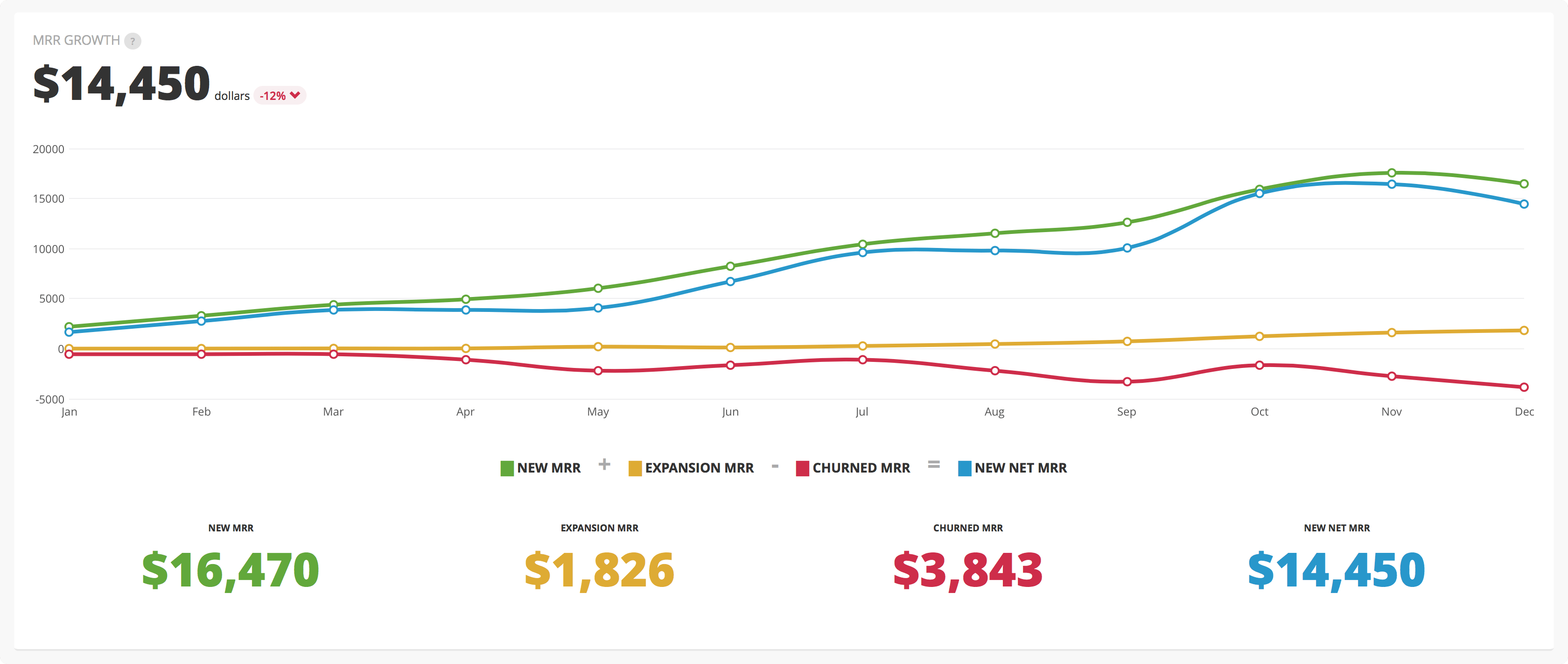

Revenue churn directly measures the impact of lost recurring revenue due to cancellations or downgrades, making it crucial for assessing your SaaS company's financial health. It offers insights into how customer churn affects your Monthly Recurring Revenue (MRR). By tracking revenue churn in conjunction with customer churn, you can enhance financial forecasting and pinpoint areas requiring retention strategies.

Here's an overview of key metrics related to revenue churn:

| Metric | Importance |

|---|---|

| Revenue Churn Rate | Indicates revenue losses |

| Customer Churn Rate | Reflects total customer loss |

| Average Revenue Per Account (ARPA) | Measures customer value |

| Target Revenue Churn Rate | Aim for less than 5% |

| Strategic Adjustments | Helps retain high-value customers |

A high revenue churn rate can signal dissatisfaction with your pricing or product value, prompting strategic adjustments. By analyzing revenue churn trends, you can implement targeted retention strategies, ultimately driving long-term profitability in your SaaS business. Monitoring revenue churn ensures you protect and grow your revenue streams effectively.

Analyzing Churn Causes

Understanding the reasons behind churn is crucial for maintaining your SaaS company's revenue and improving customer retention strategies. Revenue churn measures the percentage of recurring revenue lost due to customer cancellations or downgrades. By tracking revenue churn alongside customer churn, you gain a comprehensive view of your business health, revealing both the number of customers lost and the monetary value of that loss.

To effectively analyze churn causes, consider the following steps:

- Segment Customer Data: Identify high-risk customer personas and industries to tailor your retention strategies.

- Monitor Customer Satisfaction: Regularly survey customers to understand their needs and concerns, which can inform product improvements.

- Evaluate Financial Forecasting: Use revenue churn metrics to project potential revenue fluctuations in upcoming quarters, allowing for proactive planning.

A typical revenue churn rate for SaaS companies ranges from 5-10%. By focusing on these aspects, you can identify trends indicating deeper issues and take action before they escalate, ultimately fostering stronger subscription businesses and enhancing customer loyalty.

Mitigating Revenue Loss

Mitigating revenue loss necessitates a proactive strategy to enhance customer satisfaction and refine product offerings. Revenue churn, the financial impact of customer losses due to canceled subscriptions or downgrades, serves as a critical metric for assessing the overall health of your business.

Tracking revenue churn alongside customer churn provides a comprehensive view of financial stability, highlighting not just the quantity of customer losses but also their monetary value. A high revenue churn rate typically points to issues with product value or customer satisfaction, signaling the need for immediate retention strategies.

Strive for a revenue churn rate below 5-7% to indicate effective customer retention and ensure a stable revenue stream. Achieving this requires analyzing revenue trends over time. By identifying patterns that lead to customer departures, you can implement proactive measures to enhance customer satisfaction and reduce churn.

Customer Lifetime Value

Understanding Customer Lifetime Value (CLV) is essential for the long-term success of your SaaS company. Accurately calculating CLV provides valuable insights into profitability and customer retention, directly informing your growth strategies and attracting potential investors.

Importance of CLV

Customer Lifetime Value (CLV) is crucial for SaaS companies as it quantifies the total revenue expected from a customer throughout their relationship with the business. Understanding CLV helps make informed decisions about Customer Acquisition Cost (CAC) and sets the stage for sustainable growth.

Here are three reasons why CLV is important:

- Resource Allocation: A higher CLV justifies larger investments in CAC, enabling increased spending on marketing and sales strategies that attract and retain valuable customers.

- Customer Insight: Tracking CLV trends provides insights into customer satisfaction and loyalty, helping refine customer success initiatives and improve revenue retention.

- Strategic Planning: By analyzing the average revenue per account (ARPA) in conjunction with CLV, you can better plan marketing investments to focus on retention and upselling, ensuring a stronger financial future.

In essence, understanding Customer Lifetime Value empowers strategic decisions that enhance customer satisfaction and lead to greater profitability. Prioritizing CLV will guide your company toward long-term success.

Calculating CLV Effectively

Calculating Customer Lifetime Value (CLV) effectively is crucial for leveraging insights to drive strategic decisions. To determine CLV, multiply your average revenue per account (ARPA) by the average customer lifespan. This calculation provides a clear picture of your long-term revenue potential. A high CLV signifies your business's growth potential and is essential for attracting investors and justifying your Customer Acquisition Cost (CAC).

To enhance CLV, focus on improving customer satisfaction and retention. Elevated satisfaction and retention rates can lead to higher subscription renewals, directly increasing your CLV. Monitoring churn rates is also essential, as they significantly impact your calculations. Understanding customer behavior allows you to adjust strategies for more accurate forecasting.

Aim for a CLV that's at least four times higher than your CAC to ensure profitability and sustainable growth. By closely monitoring these metrics, you can position your SaaS company for success. Effective CLV calculations not only provide insights into your revenue potential but also guide strategic decisions to drive long-term success in a competitive market.

Customer Acquisition Cost

To accurately assess the efficiency of your marketing strategies, it's essential to monitor your Customer Acquisition Cost (CAC). This metric is calculated by dividing your total sales and marketing expenses by the number of new customers acquired within a specific period. Keeping an eye on your CAC is crucial for evaluating the effectiveness of your customer acquisition efforts and ensuring long-term profitability.

Key considerations include:

- Sustainable CAC: Strive for a CAC significantly lower than your Customer Lifetime Value (CLV), ideally maintaining a ratio of 1:3.

- Impact on Revenue Growth: A high CAC can signal inefficiencies that may impede revenue growth, even if you're successfully acquiring new customers.

- Optimize Spending: Regularly review your CAC to adjust and optimize spending, thereby improving cash flow.

As your SaaS business scales, focusing on reducing CAC while increasing customer acquisition volume is essential. This balance will help maintain healthy cash flow and support sustained growth, ensuring your marketing strategies remain both effective and sustainable over the long term.

Months to Recover CAC

Months to Recover CAC measures how quickly your business can recoup the money spent on acquiring a new customer, making it crucial for managing cash flow effectively. This metric is calculated by dividing your Customer Acquisition Cost (CAC) by your monthly recurring revenue (MRR) multiplied by the gross margin. A shorter recovery time enables faster reinvestment and enhances financial sustainability and operational efficiency.

| Metric | Ideal Value | Actionable Insight |

|---|---|---|

| Months to Recover CAC | 12 months or less | Aim for shorter payback periods |

| Customer Acquisition Cost | Lower is better | Optimize your sales process |

| Monthly Recurring Revenue | Higher is better | Focus on customer engagement strategies |

Tracking this metric over time reveals trends influenced by your sales process and customer engagement strategies. If you notice longer recovery times, it may indicate inefficiencies in your acquisition process. Regularly monitoring these metrics supports your cash flow dynamics, ensuring you maintain a healthy growth trajectory. By understanding and improving your Months to Recover CAC, you position your SaaS business for sustainable success.

CAC:LTV Ratio

Understanding the CAC:LTV ratio offers valuable insights into the effectiveness of your customer acquisition strategies, helping you gauge the long-term profitability of your investments. This ratio compares Customer Acquisition Cost (CAC) to Customer Lifetime Value (LTV), and a target ratio of 3:1 suggests sustainable growth potential.

To utilize the CAC:LTV ratio effectively, consider these key aspects:

- Efficiency: A lower CAC:LTV ratio indicates that you're efficiently acquiring customers and maximizing profitability.

- Revenue Alignment: Ensure that your marketing efforts align with long-term revenue expectations. A ratio above 1:1 confirms that the value derived from customers exceeds the acquisition costs.

- Informed Scaling: Regularly monitoring this ratio allows you to make informed decisions regarding scaling your marketing budgets and adjusting pricing strategies.

Customer Engagement Score

The Customer Engagement Score (CES) measures how actively customers interact with your product or service, indicating their satisfaction and retention likelihood. A higher CES often correlates with a lower customer churn rate, making it crucial for retention strategies. By monitoring CES, you can identify at-risk customers early and take targeted actions to improve their satisfaction.

CES is influenced by factors such as product usage frequency, feature adoption, and customer support interactions. Analyzing these elements provides insights into customer behaviors and preferences, highlighting areas for improvement. For example, low feature adoption might suggest a need for better onboarding or additional training resources.

Regular evaluation of CES can also inform your product development efforts, ensuring your offerings meet customer needs, which enhances engagement and overall satisfaction. Ultimately, focusing on CES helps you build a loyal customer base, reduce churn, and drive sustainable growth for your SaaS company.

Lead-to-Customer Rate

Measuring your Lead-to-Customer Rate is crucial for understanding how efficiently your sales process converts prospects into paying customers, directly impacting your revenue growth. This metric reveals the effectiveness of your marketing campaigns and sales strategies. A high lead-to-customer rate indicates a strong sales process, while a low rate signals areas for improvement.

To enhance your lead-to-customer rate, consider these steps:

- Identify bottlenecks in the sales funnel: Regularly review your sales process to find where potential customers disengage.

- Align lead generation with customer behavior: Use customer insights to fine-tune your marketing campaigns and attract qualified leads.

- Continuously refine sales strategies: Adjust your approach based on data to ensure your tactics resonate with prospects.

Companies achieving a Lead-to-Customer Rate above 20% typically demonstrate effective sales processes, whereas those below 10% may need to re-evaluate their strategies. By focusing on this metric, you can drive revenue growth and increase the number of paying customers.

Net Promoter Score

Net Promoter Score (NPS) is an essential metric for assessing customer loyalty and satisfaction, providing insights into the likelihood of customers recommending your services. By asking customers to rate their likelihood to recommend on a scale from 0 to 10, you can effectively capture customer sentiment.

NPS is calculated by subtracting the percentage of detractors (those scoring 0-6) from the percentage of promoters (those scoring 9-10). This score ranges from -100 to +100, offering a clear picture of customer loyalty and brand perception.

Here's an overview of NPS categories:

| NPS Category | Score Range |

|---|---|

| Promoters | 9 - 10 |

| Passives | 7 - 8 |

| Detractors | 0 - 6 |

A high NPS, typically above 50, signifies strong customer loyalty, which often leads to increased referrals and revenue growth. Regularly monitoring your NPS allows you to address issues proactively and enhance the customer experience. Companies with a strong NPS generally enjoy lower churn rates, as satisfied customers are more likely to stay loyal.

Conclusion

In conclusion, diligently tracking key performance metrics is vital for the success of your SaaS company. By monitoring Customer Churn, Revenue Churn, and Customer Lifetime Value, you can gain essential insights into customer satisfaction and overall profitability.

Keeping tabs on Customer Acquisition Cost and the CAC:LTV Ratio helps you optimize your marketing efforts. Additionally, understanding the Net Promoter Score provides a gauge of customer loyalty.

By adopting these metrics, you'll be well-equipped to drive growth and improve customer retention.