The famous investor and also founder of Techstars, Brad Feld — recently wrote a post on this blog titled “The Rule of 40% for a Healthy SaaS Business”. A couple of days later, Tomasz Tunguz an also famous venture capitalist at Redpoint Ventures also wrote a post about it, titled “The Data Behind The Rule of 40%”.

These are both awesome blog posts, and this one you’re reading now is a compilation of pretty much everything you need to know about the much-discussed topic.

The rule of 40%

The rule of 40% is nothing more than a rule of thumb to analyze the health of a software/SaaS business. It takes into consideration two of the most important metrics for a subscription company: growth and profit.

The rule simple formula is:

Which means that your growth rate plus your profit should add up to 40%. So in a simple example if you’re growing at 20% you should be generating a profit of 20%. If you’re growing at 40% you could be generating a profit os 0%. If you’re growing at 50% you could even lose 10%.

So if you’re doing 40% you can consider you have a healthy business — If you’re doing more than that, well, that’s awesome.

Growth Rate

You can measure growth in different ways but the easiest one probably just does YoY (year-over-year) on MRR growth. You can always compare total revenue but it’s important to consider monthly revenue, especially if you have one time services in the mix.

Profit

You can also measure profit in a SaaS business — or any business at all — in many different ways. There are plenty of options in GAAP accounting such as Operation Income, Net Income, Free Cashflow, Cashflow and more, but the most well known and used metrics for startups and especially SaaS companies is EBITDA.

Earnings before interest, taxes, depreciation, and amortization is a way to measure profits without having to consider other factors such as financing costs (interest), accounting practices (depreciation and amortization) and tax tables.

So if you’re using AWS or any cloud infrastructure provider to host your product/solution, your COGS (Cost of Goods Sold) will pretty much scale with your revenue and maintain your gross margin. If you’re self-hosting it EBITDA might not be your best option — or at least should be completed with other metrics — because of equipment purchases, debt to finance them, or lease expense.

Growth vs. profit

So the general thing about the rule is that you can even lose money if you’re growing, and that’s the whole thing about startups and venture capital. Since we’re looking for a monopoly of our markets — especially in SaaS that is usually a winner-takes-all situation — you want to sacrifice profit for growth.

Customer acquisition costs are one of the main reasons why SaaS companies lose money in their first years before becoming profitable. You need to make sure you’re investing all you can in order to acquire as many customers you can so you create a monopoly.

As Pether Thiel have pointed out in his incredible book “Zero to One” what a startup wants to do is to create a monopoly so they can set a price for a product/service and discreet of high margins — totally differently from companies that work on a perfect competition market with product with little or no differentiation fighting for a piece of the market purely based on price.

When to follow this rule?

Most part of SaaS business can get profitable in the early years if they down their growth rate, but that’s not what we want to do. There’s actually another rule of thumb that helps us to get a sense of how much we should invest in growth before pursuing profit called the T2D3 approach. It pretty much tells you to triple your size/revenue for two years in a row, and then double it for three years in a row. After that, you should pursue the rule of 40%.

Another interesting point raised by Brad Feld was the rule is supposed to fit for SaaS companies at scale — assume at least $50 million in revenue — but it correlates nicely with it once you hit about $1 million MRR.

Who should follow this rule?

The first thing I thought after reading the post was “Does this rule really applies to SaaS companies only? What about any other subscription business?”. And yes it applies to software only, and for a simple reason for most of these businesses.

The calculation is usually used by venture capitalists trying to understand whether they should invest in a business or not. It allows balancing profit and growth even if there is no growth or profit yet. VCs are generally looking for a score of 40 or above. A score between 40-60 is considered outstanding, while a score below 40 means that a business has failed this test. The Rule of 40 really shines when it comes to young and budding companies with brilliant ideas, but an unproven track record.

The main reason the rule of 40 is used instead of analyzing just profit and growth is because it helps understand the trade-offs between the two. If a company is showing rapid growth, investors might be willing to tolerate low profits or even net losses. This is common in fast-growing companies that invest heavily in research and development and are not too much concerned about profitability in the short term. A negative profit is a bad news for most businesses, but in the SaaS world it can be forgiven if a company is demonstrating outstanding growth.

However, the Rule of 40 is not just meant for startups and growing businesses as it also applies to established businesses. Larger and established businesses usually have a slower growth rate and higher profit margins. It’s not uncommon for large businesses to outperform the rule in a single year, but maintaining the same kind of performance on a year-on-year basis is difficult. That’s because once a business has matured, it becomes difficult to maintain growth and that’s when profit starts making a large chunk of the equation.

How do SaaS Businesses Hit the Mark?

SaaS businesses that achieve stellar growth or retain high profit margins strive to hit the mark in all their life cycle stages. However, not all businesses follow the same strategy and therefore have a different score.

Strong growth

Around one-third of companies that pass the Rule of 40 over a five-year-time make it through 30% or above growth rate. Most of these companies are modestly profitable and invest a lot of money into R&D and hyper-growth. These companies look for ways to increase profitability to beat the Rule as they mature and the growth rate slows down.

Profitability

Established SaaS businesses such as Oracle have a slow growth rate (usually below 10%), but higher profitability. These businesses strive to become more efficient and can leverage their large salesforces to expand their existing customer base, renewals and discover new business models.

Balanced Approach

A large number of SaaS businesses aim to strike the right balance between profitability and growth. Most of these businesses such as Adobe are established, have fully developed and well-marketed products and have moved to the subscription-based model. R&D spending of these companies generally does not reflect that they are aiming for breakthroughs as they are more focused on improving on the original product.

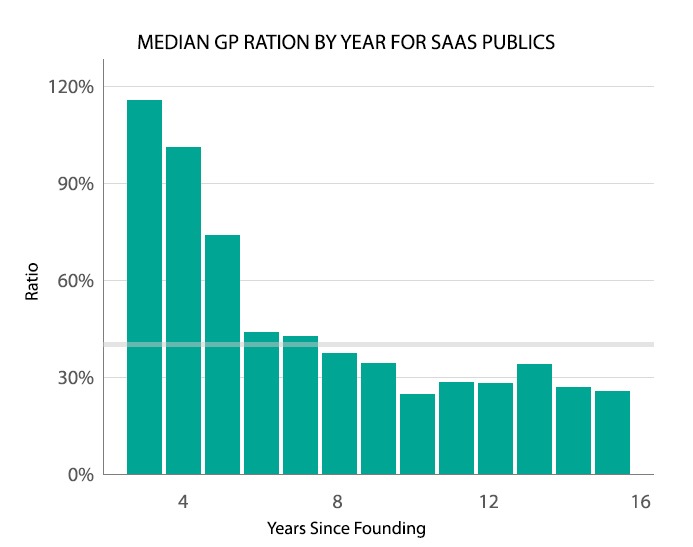

Median GP Ratio

Median GP Ratio by Year for SaaS Publics.

As you can see the median figures around year six and seem to support the case that the rule of 40% can be a good filter for investors in later stage companies.

There’s also interesting to see that these metrics could be much greater in the early days of SaaS companies, sometimes exceeding 100%, which means companies are growing super fast of generating tons of profit. Usually — and especially in the early days — companies tend to sacrifice profit for growth, so probably most past of this number is due to growth rates.

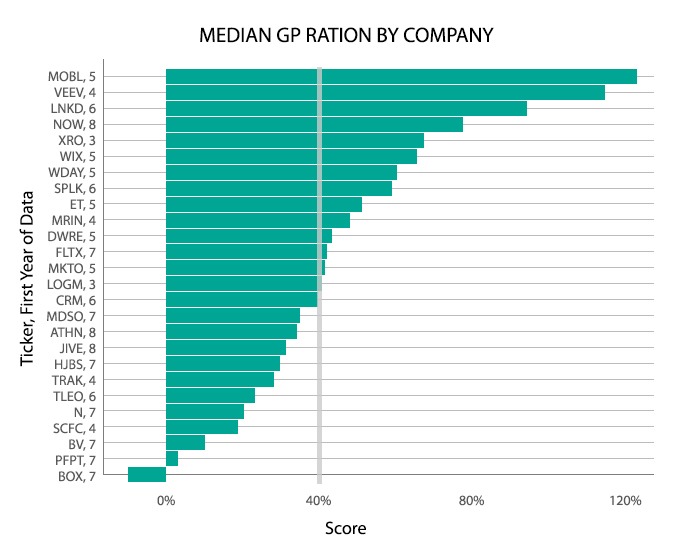

Median GP Ratio by Company

Median GP Ratio by Company.

As these companies grow old they haven’t been able to sustain the 40%. This chart represents the GP Metrics across the number of years which they have provided data for public market investors.

At the end of the day, the 40% rule is definitely a good rule of thumb for later stage investors. If you’re running an early stage startup you should focus on unit economics first (ARPA, CAC, LTV, Churn, etc) until you get to a point the rule makes sense for you.

Conclusion

The Rule of 40 is an effective way of quickly gauging performance of a SaaS company and widely used by both companies and investors. The calculation is not only useful for understanding growth and performance as a whole, but also as a method to access performance of different product families or business units within an organization. It helps companies quantify their goals and focus on achieving excellence at a unit level.

The calculation also helps investors compare apples vs. oranges as all businesses cannot be compared against each other just on the basis of profitability or growth. Interpretation of definitions of various metrics usually differ in the world of SaaS and other cloud computing technologies due to the recurring business model. The Rule of 40 makes it easier to measure growth-profitability of a company and compare it against competitors to have a better understanding of the future trajectory.