15 Metrics Every SaaS Company Should Care About

Managing a SaaS company requires paying close attention to key metrics that drive success. Understanding customer churn rates and the time it takes to recover your Customer Acquisition Cost (CAC) can significantly impact your strategy. Monitoring Monthly Recurring Revenue (MRR) growth is essential for assessing financial health. Additionally, measuring customer loyalty through the Net Promoter Score (NPS) provides valuable insights. Curious about how these metrics interact to ensure your company's success? Let's explore the critical numbers that truly matter.

Customer Churn

Customer churn, defined as the percentage of customers who discontinue their service over a specific period, is a crucial metric for SaaS companies. Typically, customer churn rates range from 5-7%, and understanding these rates is essential for assessing overall business health. High churn rates can indicate underlying issues with product satisfaction or engagement, significantly affecting revenue.

By delving deeper into churn data beyond the sheer number of customers lost, you can identify particular customer personas or industries more likely to cancel their subscriptions. This detailed analysis facilitates the development of targeted retention strategies, which can enhance customer retention rates. Encouraging cross-departmental discussions about churn is vital, as these conversations can yield actionable insights that improve customer success and overall experience.

Monitoring customer churn alongside revenue churn provides a comprehensive view of your financial health. These metrics and KPIs help anticipate quarterly and yearly performance outcomes, offering a clearer picture of your subscription business's sustainability. Focusing on these aspects ensures you can proactively address issues, boost customer satisfaction, and ultimately reduce churn, driving long-term growth and stability for your SaaS company.

Revenue Churn

Understanding revenue churn is crucial for any SaaS company aiming to maintain financial health and sustainability. Revenue churn measures the percentage of recurring revenue lost due to customer cancellations, downgrades, or non-renewals. Unlike customer churn, which focuses on the number of customers lost, revenue churn assesses the financial impact of these losses, providing essential insights into variable subscription pricing.

Monitoring revenue churn alongside customer churn enables you to predict quarterly and yearly financial performance, aiding in the implementation of proactive retention strategies. A high revenue churn rate often signals deeper issues with customer satisfaction or product value, which can significantly affect long-term growth and profitability.

To maintain a healthy SaaS business, aim for a revenue churn rate below 10%. This target correlates with strong customer retention and overall business stability. Here's why keeping an eye on revenue churn is crucial:

- Anticipate financial performance: Helps forecast future revenue and identify potential financial shortfalls.

- Customer satisfaction insights: High revenue churn can indicate dissatisfaction, prompting necessary improvements.

- Retention strategies: Understanding revenue churn helps develop effective tactics for enhancing customer retention.

Customer Lifetime Value (CLV)

Calculating Customer Lifetime Value (CLV) is crucial for SaaS companies aiming to enhance long-term profitability. CLV represents the total revenue you can expect from a single customer account throughout their engagement with your company. To calculate CLV, multiply the average revenue per account (ARPA) by the average customer lifespan. A higher CLV signifies greater potential profitability and a robust customer relationship.

You can significantly improve your CLV through strategies like subscription renewals and upselling. These methods not only boost revenue but also strengthen customer relationships, fostering sustainable growth. Understanding your CLV helps you evaluate your Customer Acquisition Cost (CAC) in relation to the value provided by your customers. Ideally, aim for a CLV to CAC ratio of 3:1 to ensure profitability.

Regularly tracking and analyzing CLV offers valuable insights into customer behavior and satisfaction. This data enables you to adapt your marketing and retention strategies effectively, ensuring you meet customer needs and expectations. By focusing on CLV, you can make informed decisions that drive long-term success for your SaaS company.

Customer Acquisition Cost (CAC)

Maximizing Customer Lifetime Value (CLV) is essential for long-term profitability, but it's equally important to monitor Customer Acquisition Cost (CAC) to avoid overspending on new customers. CAC is determined by dividing total sales and marketing expenses by the number of new customers acquired within a specific timeframe. This metric offers crucial insights into the efficiency of your marketing strategies.

To ensure sustainable growth, aim for a CAC significantly lower than your Customer Lifetime Value (CLV), with an ideal CLV:CAC ratio of 3:1. A high CAC may signal inefficiencies in your acquisition process, making it imperative to analyze and optimize your marketing and sales efforts for enhanced profitability.

Regularly monitoring your CAC allows you to evaluate the effectiveness of your acquisition strategies and make informed budgeting decisions. Key considerations include:

- Efficient targeting: Ensure you're reaching the right audience to lower acquisition costs.

- CAC Payback Period: Strive to recover your CAC within 12 months to maintain financial health.

- Sustainable growth: Keep your CAC under control to ensure long-term business viability.

Months to Recover CAC

Months to Recover CAC (Customer Acquisition Cost) is a crucial metric for SaaS companies, as it indicates the time needed to recoup the costs spent on acquiring a customer. Calculated by dividing the CAC by the product of monthly recurring revenue (MRR) and gross margin, this metric provides valuable insights into the financial health of your business.

A shorter recovery period is vital for maintaining healthy cash flow and ensuring the financial stability of your company, particularly as you scale. Ideally, you should aim for a recovery period of around 12 months. This target strikes a balance between growth and profitability, helping you manage both effectively.

The complexity of your sales process significantly impacts this metric; simpler sales cycles generally lead to quicker recovery of CAC. By monitoring this metric, you can evaluate the efficiency of your customer acquisition strategies and make informed adjustments to drive future growth.

Annual Recurring Revenue (ARR)

Annual Recurring Revenue (ARR) is a foundational metric for SaaS companies, offering a clear view of the total recurring revenue generated from customers over a 12-month period. Understanding ARR is crucial for effective long-term financial planning and assessing your company's revenue potential. ARR can be segmented into categories: New, Lost, Expansion, and Contraction, each providing insights into different aspects of customer behavior and business performance.

An increase in ARR typically indicates business growth. For companies with up to $10 million in ARR, aiming for at least 20% annual growth is vital to remain competitive. Investors heavily rely on ARR trends to evaluate financial health and predictability, making it a key metric for securing investment.

Accurate ARR tracking is essential. Management software can assist in handling complex scenarios, ensuring reliable reporting and strategic decision-making.

- Understand ARR segments: New, Lost, Expansion, and Contraction.

- Set growth targets: Aim for 20% annual growth.

- Utilize tools: Management software aids in accurate tracking.

Monthly Recurring Revenue (MRR)

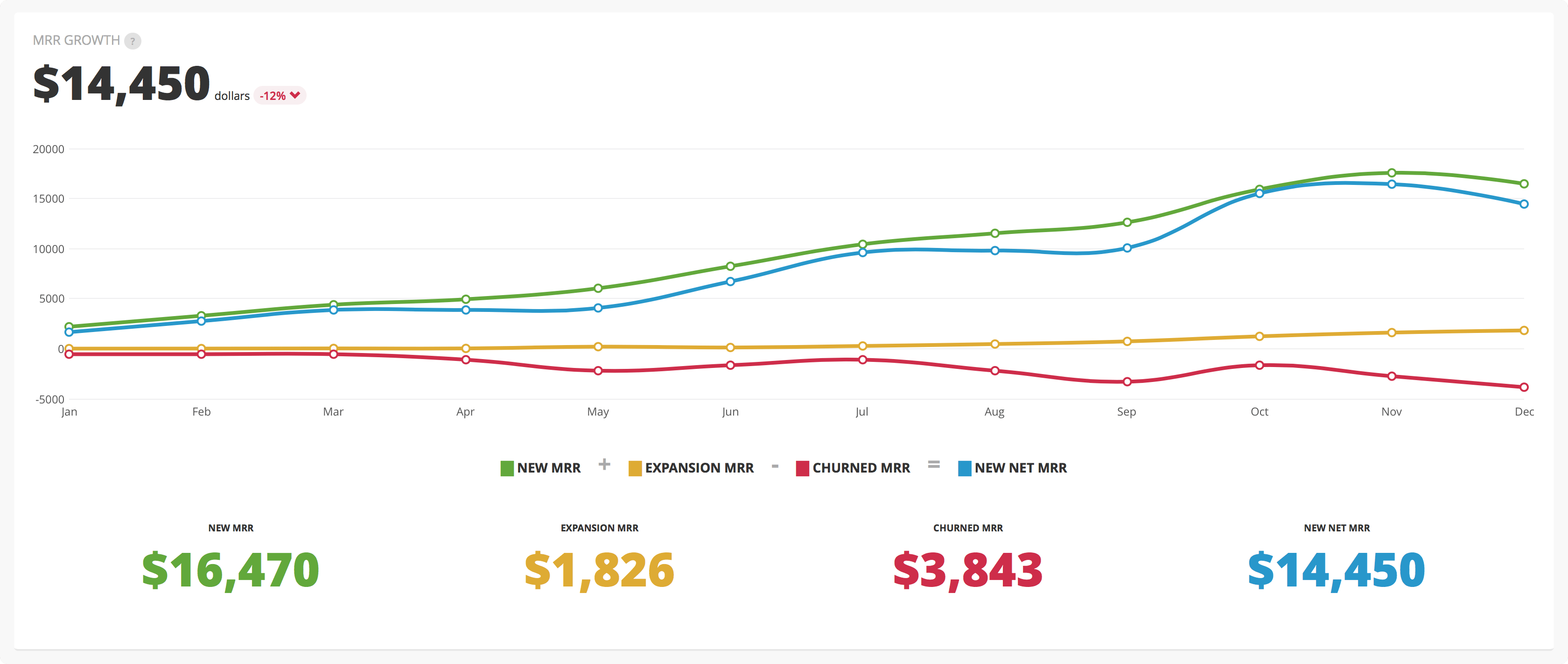

Calculating Monthly Recurring Revenue (MRR) involves more than just capturing a monthly income snapshot; it also entails tracking critical revenue trends over time. By categorizing MRR into segments such as New, Expansion, Contraction, and Churned, you can gain valuable insights into your subscription revenue dynamics. This comprehensive analysis aids in forecasting future revenues and making informed decisions to drive sustainable growth.

Calculating MRR Growth

Calculating Monthly Recurring Revenue (MRR) growth is essential for SaaS companies, offering a clear perspective on revenue trends and business health. To determine the MRR growth rate, subtract last month's MRR from this month's MRR, divide by last month's MRR, and multiply by 100. For example, if your MRR was $790,000 this month and $660,000 last month, your growth rate would be approximately 19.70%.

Tracking MRR growth is critical for several reasons:

- Financial Planning: Accurate forecasting and financial planning rely heavily on understanding MRR growth.

- Customer Acquisition: It reflects the effectiveness of your strategies in acquiring new customers.

- Retention Strategies: It indicates how well you are retaining your existing customers.

Consistent double-digit growth, typically 10% or higher, signifies robust market traction and can attract potential investors. By closely monitoring MRR growth, SaaS companies can identify trends, adjust strategies as needed, and ensure sustainable long-term success. Regularly reviewing these numbers is crucial for making informed business decisions.

Tracking Revenue Trends

Tracking and understanding revenue trends through Monthly Recurring Revenue (MRR) is essential for SaaS companies targeting sustainable growth. MRR quantifies the predictable monthly income from subscriptions, offering a clear view of your company's financial health. Calculating the MRR growth rate allows you to compare current MRR against previous periods, with double-digit growth rates indicating strong market traction, particularly for post-Seed or Series A startups.

To gain deeper insights, track variants such as Net New MRR and Expansion MRR. Net New MRR shows revenue consistency by balancing new customer subscriptions against churn, while Expansion MRR highlights revenue growth from existing customers through upsells and cross-sells. These metrics are crucial for assessing the stability of your revenue streams.

Accurate MRR tracking also aids in forecasting future revenue. It reflects your ability to retain and expand your customer base, allowing for precise strategic planning. Utilizing management software can streamline this process, handling complex MRR scenarios efficiently. In summary, closely monitoring your MRR and its components is vital for the long-term success of your SaaS business.

Subscription Revenue Streams

After exploring how tracking revenue trends through Monthly Recurring Revenue (MRR) is vital for sustainable growth, it's time to delve into the different subscription revenue streams that contribute to MRR. Understanding these streams will help you better manage and predict your company's financial health.

First, there's New MRR, which comes from new customers subscribing to your service. This stream is fundamental for initial revenue growth, especially for startups. Next, Expansion MRR is generated from existing customers upgrading their plans or purchasing add-ons. This stream often indicates satisfied customers and can greatly enhance your revenue growth rate. Finally, you have Churned MRR, which represents the revenue lost from customers canceling their subscriptions. Minimizing churn is key for maintaining steady MRR.

To better manage these subscription revenue streams, consider the following:

- Focus on customer retention: Implement strategies to keep existing customers happy and reduce Churned MRR.

- Monitor MRR growth rate: Aim for a double-digit growth rate, particularly significant for startups in the post-Seed or Series A stages.

- Track all MRR variants: Keep an eye on New MRR, Expansion MRR, and Churned MRR to get a thorough understanding of your business performance.

CAC-to-LTV Ratio

The CAC-to-LTV ratio is a vital metric for SaaS companies, illustrating the balance between customer acquisition costs and the long-term revenue generated from those customers. By comparing Customer Acquisition Cost (CAC) to Customer Lifetime Value (LTV), you can evaluate if your business is on a path toward sustainable growth. An ideal ratio of 3:1 indicates that your customer acquisition efforts are efficient, with each customer generating three times the revenue relative to their acquisition cost.

To calculate the CAC-to-LTV ratio, divide LTV by CAC. This straightforward formula helps assess the effectiveness of your marketing strategies and overall profitability. A lower ratio suggests that you are spending less on acquiring customers than the revenue they generate, indicating efficient marketing and sales strategies.

Conversely, a high CAC-to-LTV ratio can be a concern. It indicates that customer acquisition is too costly compared to the revenue produced, necessitating a reevaluation of your marketing tactics or pricing strategies. Regularly monitoring this ratio enables informed decisions about scaling, resource allocation, and future investments in customer acquisition efforts, ensuring your SaaS business remains profitable.

Customer Engagement Score

To gain deeper insights into your customers, begin by measuring the frequency and intensity of their interactions with your SaaS product. Monitoring this engagement helps identify users at risk of churn, enabling you to address their concerns proactively. This approach not only boosts retention rates but also enhances overall customer satisfaction.

Measuring Interaction Frequency

Tracking the frequency and quality of customer interactions with your product is crucial for gauging engagement levels. Customer Engagement Scores quantify these interactions, providing essential metrics for forming effective retention strategies and boosting overall satisfaction. Higher engagement scores often correlate with lower churn rates, as engaged customers are more likely to renew their subscriptions and advocate for your product.

Regularly monitoring customer interactions delivers invaluable insights, which can:

- Highlight valuable features: Identifying the most utilized features can steer product enhancement efforts.

- Reveal usage patterns: Analyzing data by customer demographics uncovers varying behaviors and needs.

- Inform targeted interventions: Spotting less engaged users enables timely actions to improve their experience.

Thoroughly analyzing customer interactions allows you to tailor retention strategies for reduced churn rates. Segmenting data by usage patterns and demographics ensures a comprehensive understanding of your customer base's diverse needs. This data-driven approach not only guides product improvements but also enhances customer satisfaction by addressing specific requirements.

Identifying At-Risk Users

Leveraging the Customer Engagement Score is crucial for identifying at-risk users in your SaaS product. By measuring customer interactions, you can gauge satisfaction and loyalty. Higher scores generally indicate lower churn rates, suggesting these users are less likely to leave.

Tracking engagement metrics, such as usage frequency and feature adoption, enables you to detect at-risk users early. This allows for timely interventions to enhance their experience and retention. Regular evaluations of the Customer Engagement Score provide insights into customer behavior, helping you prioritize customer success initiatives and allocate resources efficiently.

Understanding your Customer Engagement Score also aids in product development. By anticipating customer needs, you can refine the user experience, making your product more appealing. High engagement scores also indicate upsell opportunities; engaged users are more likely to purchase additional features or services.

Ultimately, monitoring the Customer Engagement Score helps you address issues proactively, reduce churn rates, and capitalize on upsell opportunities. Keeping a close eye on these metrics ensures your SaaS company remains competitive and customer-centric.

Qualified Marketing Traffic

Qualified Marketing Traffic is crucial for SaaS companies aiming to convert website visitors into paying customers. By targeting qualified traffic, you can measure the effectiveness of your marketing campaigns and identify which channels generate the most valuable leads. This not only optimizes your conversion rate but also ensures a better return on investment (ROI).

Tracking qualified traffic enables more efficient resource allocation. By pinpointing the sources of your highest quality leads, you can fine-tune your marketing efforts to target the right audience. Here are the key benefits:

- Improved Conversion Rates: Attracting visitors who are more likely to convert streamlines your sales process and boosts overall sales.

- Better ROI: Focusing on the most effective marketing channels ensures that every dollar spent brings in high-quality leads.

- Insight into Customer Behavior: Analyzing trends in your qualified traffic helps you understand shifts in customer behavior, allowing you to adjust your strategies accordingly.

Monitoring qualified marketing traffic is essential for SaaS companies. It offers valuable insights that help refine marketing strategies, enhance the sales process, and support sustained growth.

Lead-to-Customer Rate

The Lead-to-Customer Rate is a crucial metric for SaaS companies, measuring the effectiveness of sales processes and marketing strategies. This rate indicates the percentage of leads that convert into paying customers, providing valuable insights into the performance of your sales funnel. A higher Lead-to-Customer Rate signifies a more efficient sales process, essential for revenue growth and resource optimization.

Monitoring this rate helps identify bottlenecks in your sales processes, allowing you to adjust strategies to enhance conversion rates and improve customer onboarding experiences. For SaaS businesses, aiming for a Lead-to-Customer Rate that aligns with industry benchmarks—typically between 1% to 5%—is advisable, though this can vary based on your target market.

Regular analysis of your Lead-to-Customer Rate is critical. It informs future lead generation strategies and significantly impacts overall sales performance. By understanding and optimizing this metric, you can better forecast revenue growth and ensure that your marketing and sales efforts produce meaningful, measurable results. Focus on refining your conversion strategies to turn more leads into satisfied, paying customers.

Customer Health Score

After optimizing your Lead-to-Customer Rate, the next focus should be on the Customer Health Score, a crucial indicator of overall customer satisfaction and engagement. This score helps you identify at-risk customers and refine retention strategies. A higher Customer Health Score usually correlates with lower churn rates, suggesting that satisfied customers are more likely to stay and generate recurring revenue.

To calculate the Customer Health Score, consider these metrics:

- Product usage frequency

- Customer support interactions

- Feedback from satisfaction surveys like CSAT

Regular monitoring allows you to proactively address customer issues, leading to better upsell opportunities. Segmenting customers based on their health scores enables tailored customer success initiatives, thereby enhancing engagement and loyalty.

Net Promoter Score (NPS)

The Net Promoter Score (NPS) is a powerful metric for measuring customer loyalty and satisfaction, especially in SaaS companies. NPS gauges the likelihood that customers will recommend your products or services on a scale from 0 to 10. It is calculated by subtracting the percentage of detractors (scores 0-6) from the percentage of promoters (scores 9-10), providing a clear picture of overall customer sentiment.

An NPS above 50 typically signifies strong customer loyalty, which often correlates with lower churn rates and higher revenue growth. Regularly evaluating your NPS allows you to benchmark against competitors and identify areas for improvement in customer experience. Enhancing these experiences can significantly impact customer retention.

Monitoring your NPS and acting on feedback can also create upsell opportunities. Satisfied and loyal customers are more likely to explore additional services or features you offer, contributing to long-term growth. Therefore, making NPS a cornerstone of your strategy ensures continuous improvement in customer engagement and loyalty, driving sustained success for your SaaS business.

Expansion Revenue

Building on insights from analyzing your NPS, the next logical step is to focus on expansion revenue. Expansion revenue, derived from upselling and cross-selling to existing customers, is crucial for sustaining growth in a SaaS business. It significantly impacts Net Revenue Retention (NRR), with higher expansion revenue contributing to an NRR above 100%, signifying effective customer growth strategies.

Tracking expansion revenue allows you to pinpoint which product features and services are most valued by customers, guiding future marketing and sales initiatives. Companies that excel in generating expansion revenue often reduce their dependency on acquiring new customers, leading to lower Customer Acquisition Costs (CAC) and increased profitability.

Focusing on expansion revenue can also mitigate losses from churn, playing a vital role in sustaining overall revenue growth and ensuring long-term business health. Key strategies include:

- Upselling opportunities: Promote advanced features to existing customers.

- Cross-selling: Offer related products or services.

- Customer feedback: Utilize feedback to enhance and refine offerings.

Active Users

Consistently tracking Active Users, measured by Daily Active Users (DAU) and Monthly Active Users (MAU), is essential for assessing customer engagement and the overall health of your SaaS product. A higher number of active users indicates a strong product-market fit and robust customer engagement. By monitoring these metrics, you can identify usage patterns and trends, enabling you to proactively address potential churn by enhancing features and improving customer experiences.

A significant drop in active users can signal issues with user satisfaction or product value, necessitating immediate investigation and action to retain customers. Understanding why users are disengaging is critical to preventing further churn and maintaining a loyal customer base.

Moreover, engaging more active users opens up upsell opportunities. Satisfied users are more likely to explore additional features or services your company offers, driving revenue growth. For effective growth forecasting, aim for a consistent increase in active users. This steady growth correlates with long-term sustainability and strong revenue growth, ensuring your SaaS product remains competitive and valuable in the market. Keeping a close eye on active users helps you continually refine your product, enhancing user satisfaction and overall success.