POS (Point of Sale) systems have come a long way from just being a tool to facilitate sales transactions. Modern POS systems consist of hardware and software components, and include components that not only facilitate sales transactions, but also enable businesses to manage customer information, inventory and more.

Although the main objective of POS systems is to streamline the checkout process, they also include capabilities to track sales, provide actionable insights and manage inventory. However, it’s important to align the capabilities and feature set of a POS system with business goals and requirements. Picking the right POS solution can be challenging and requires some homework and due diligence. Although there is no one-size-fits-all POS solution that perfectly aligns with every business, there are some important considerations that can help businesses pick the most suitable solution.

What is a POS System?

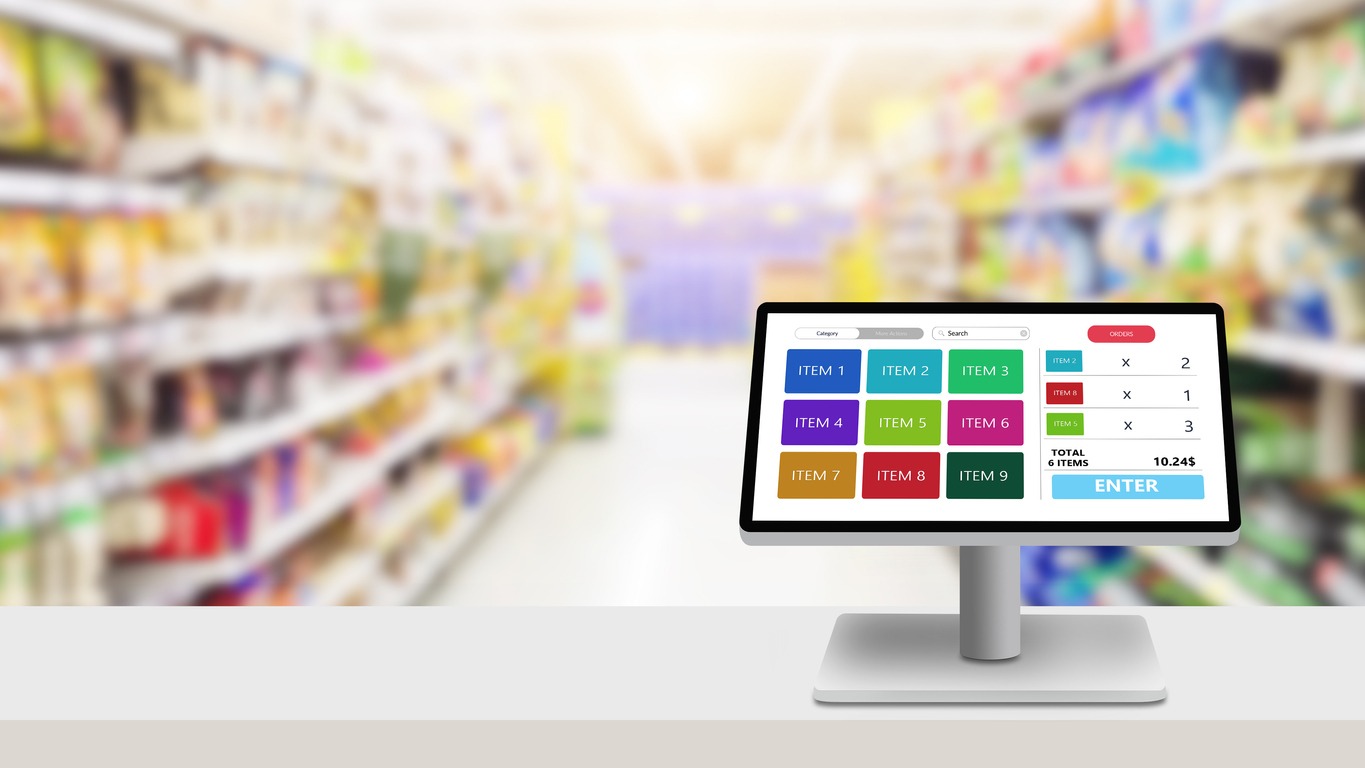

A point-of-sale system can be defined as the point of purchase where customers can check out in a physical store, through a mobile business such as food trucks or even online. The main function of a POS system is to facilitate sales transactions and keep track of sales. It is a combination of both software and hardware and a setup may include a cash register, receipt printer, barcode scanner, and software for viewing customer information, inventory and managing sales. How a POS system works primarily depends on whether you are selling at a physical place, online or both.

Many POS systems today are totally digital and all you need is an internet connection, a POS app and a phone or a tablet to run the app. All POS systems need a POS software, but not all systems need special hardware to work. Online stores don’t need POS hardware to accept orders and process payments. Similarly, physical stores need a credit card reader and a register to accept and process payments. The best POS systems for retail businesses might not work well for online businesses and vice versa as different POS systems are designed keeping specific requirements in mind.

Key Considerations When Buying a POS System

Understand Business Needs

Needs and requirements vary from one industry and business to another. A POS system that helps restaurant businesses grow might not be the best option for retail businesses, which is what makes understanding business needs and unique business characteristics so important. Consider factors including products/services on offer, the industry and the type of business you are in e.g. you need table management for restaurants and inventory tracking for retail businesses.

Specific Functionalities and Requirements

In addition to payment processing and checkouts, some other common requirements include:

- Real-time inventory tracking

- Real-time reporting

- Sales analytics

- Customer loyalty programs

- Integration Capabilities

Chances are good that businesses planning to invest in a POS system are already using other systems, including accounting, CRM, and e-commerce platforms. A POS that can seamlessly integrate with the existing systems minimizes chances of data duplication and can improve operational efficiency.

Cost Considerations

Cost is an important factor to consider when choosing between different POS systems and is the deciding factor more often than not. However, cost should be considered along with other important factors and should not be the only deciding factor. Some important cost considerations include:

Upfront Costs

On-premises POS systems tend to have a lot higher upfront cost associated with hardware/software and maintenance than SaaS solutions. The upfront costs should align with the budget, which is why most SMBs prefer going for a SaaS solution than costly on-premises solutions. Although upfront costs for SaaS solutions are generally much lower, things are a little different when it comes to POS systems as hardware is also involved.

On-going Fees

These include fees associated with using a POS system, including fees associated with support, transactions, maintenance and technical support/bug fixes. Dedicated support costs more than standard support. Most SMBs find standard support a more cost-effective option that suffices for their needs. Transaction fees are usually charged based on the value or the number of transactions, and are important to consider when calculating the total cost of ownership of a POS system.

Return on Investment

When investing in a POS system, businesses should consider the long-term value of a POS system instead of only focusing on short-term gains. Factors such as increased productivity and efficiency, better inventory management, reduced errors, and better customer experience all lead to potential revenue growth. However, this value is realized in the long-term, which is why businesses need to access the ROI keeping their long-term goals in mind.

Key Features to Look for in a POS System

The list of features and functionalities can vary from one POS solution to another, but there are some essential features that allow businesses to manage sales and inventory more effectively, including:

Sales and Inventory Management

Allows businesses to process sales transactions, keep stock quantities updated, track inventory levels and maintain accurate sales records.

Reporting and Analytics

Robust reporting and analytics capabilities enable businesses to make better business decisions through trend analysis, detailed sales reports, inventory reports and performance insights.

Customer Data Management

A POS system enables businesses to collect and store customers’ data, including their purchase history, contact information and personal preferences. This information can be used to carry out targeted marketing campaigns, offer personalized customer experiences and offer loyalty programs based on actual data.

Payment Options

Customers now have multiple payment methods at their disposal and within each, there may be different options. For example, within the credit card category you have Visa, Mastercard, American Express and more. Even cards use different technologies, including NFC, EMV and magstripe. Businesses need to consider the payment method(s) their customers want to use and the POS should support those methods.

Security and Compliance

A POS system has to comply with local regulations and industry standards. For example, PCI (Payment Card Industry) compliance is necessary for businesses that accept payments through cards. A POS goes well beyond a cash register by allowing businesses to accept payment from multiple channels, including cash, credit/debit cards, virtual wallets like Apple Pay and even virtual currency. However, payments have to be secure, safe and compliant to regional and global regulations.

Security and compliance of payments is essential and a POS should adhere to relevant standards such as PCI-DSS (Payment Card Industry Data Security Standard). Industry standards set the guidelines for processing, storing and communicating data of cardholders and protects critical information from fraud and data breaches.

Data Encryption

Sensitive and confidential information including transaction details and customer information have to be securely stored and transmitted. Encryption is one of the ways to protect that information from unauthorized access. Understand what security and encryption measures the vendor has taken, including encryption technology, access controls, data backup policy and other security protocols.

Additional Features

Many businesses need more than the standard features to manage their operations more effectively. Modern POS systems go well beyond facilitating sales transactions and also include additional features, including employee management and scheduling, support for multiple locations, integration with e-commerce platforms and mobile compatibility. These additional features are worth considering if your business only requires basic functionality and does not plan on using dedicated software for these capabilities.

Customization Options

The right POS system should offer the customization options a business needs and be flexible enough to allow businesses to tailor it according to their branding and unique business processes. The ability to add or customize fields, workflows and features, and compatibility with other systems enhances the operational efficiency and allows businesses to extract more value from their IT investment.

Mobile Accessibility

Mobile devices have become a common place in business environments and considering their usability, accessibility and other benefits, it’s an important factor to consider when picking a POS solution. Many POS systems only require a tablet/mobile and an internet connection to work, and allow businesses to use mobile devices as mobile registers. This can be very helpful in off-site events and works great for mobile businesses.

Implementation and Data Migration

Vendors that provide clear setup instructions and have straightforward implementation processes make the whole process a lot easier, especially when you are running a small business with little IT expertise. Less technical requirements mean a smooth implementation process. Businesses switching from another POS system might have a large amount of data to transfer, which is only possible when the new vendor has efficient and accurate data migration processes in place. Data migration requirements have to be clear and well-documented.

Evaluate the training and on-boarding processes and consider if the vendor is offering comprehensive training materials, training sessions and a carefully structured onboarding process for a smooth transition.

Scalability and Flexibility

A POS system should be able to grow with the business and accommodate seasonal spikes, increased transaction volumes, and allow adding new locations and additional capabilities. A scalable and flexible POS can save businesses from a replacement or complete overhaul due to evolving business needs.

On-premises vs. SaaS POS Systems

On-premises deployment refers to local installation and management of a software, while SaaS POS systems rely on the internet to operate and are accessible from anywhere, using almost any device, including mobile devices. SaaS solutions usually come with automatic updates and are highly scalable, making them suitable and cost effective for small and medium sized businesses. On-premises solutions on the other hand are expensive, but provide better control and are well suited for large businesses and enterprises.

On-premises POS systems make more sense for businesses looking for a solution they can run without totally relying on the internet. However, it requires them to make large, but (usually) one-time hardware and software investments.

SaaS POS solutions work great for businesses, especially SMBs that want to quickly get started without making heavy IT investments. Choosing between an on-premises or a SaaS solution depends on many factors, which we have already discussed in detail in the linked post. In a nutshell, SaaS makes budgeting simpler, is highly scalable, and significantly shortens the implementation time. On-premises POS solutions are costly, but provide more control and tend to be highly customizable.

Ease-of-Use, User Interface

A complex POS system that requires a lot of training can slow down the adoption rate and make life harder for the sales people. An easy-to-use and intuitive interface means less time spent training employees, higher adoption rate, less errors and enhanced productivity. Easy to navigate interface and straightforward workflows minimize the learning curve and contribute to a better user experience.

Support Options and Software Updates

Not everyone is tech savvy enough to fix software issues themselves and at some point, employees might have to contact the support team. Availability of support and training resources is important when evaluating different solutions. Availability of product documentation, user guides, online support channels and video tutorials are a good indicator that the vendor cares about its customers and is willing to help them use and troubleshoot its solution.

Regular updates and easy access to the customer support team or the help desk ensure reliable and smooth functioning of a POS system. Support is not just limited to customer support. It also includes regular software updates and fixing security vulnerabilities in a timely manner.

How to Choose the Right POS System?

Researching and considering user feedback is crucial when evaluating different vendors. POS vendors with a positive reputation and a proven track record should be considered, while evaluating their market presence and industry experience is also important. References and customer reviews are a great starting point and provide you with valuable insights into the quality of support and services a vendor offers. Get in touch with the vendor and ask for references.

If they are confident about their services, they would not hesitate to share some with you. Look for feedback from similar businesses as yours and gather first-hand information about the reliability and responsiveness of the vendor. A POS vendor should be financially stable and viable. Its size, time in the industry and financial strength are good indicators of how stable and reliable a vendor might be. No business wants to work with an IT partner that might go bankrupt in the future or might not deliver the services as promised.

Conclusion

A POS system can be a great investment for both new businesses and companies that want to keep up with their growth. It should align with business needs, which vary from one business to another. Identifying current and future needs is one of the most important steps in finding the right solution, especially when picking one for a retail business. Some POS systems are tailored for great customer experiences, while others are more focused on retail businesses. The right solution is the one that enables a business to streamline its sales process, makes transactions safer, accurate and faster, and improves business process efficiency while staying aligned with business goals and long-term objectives.